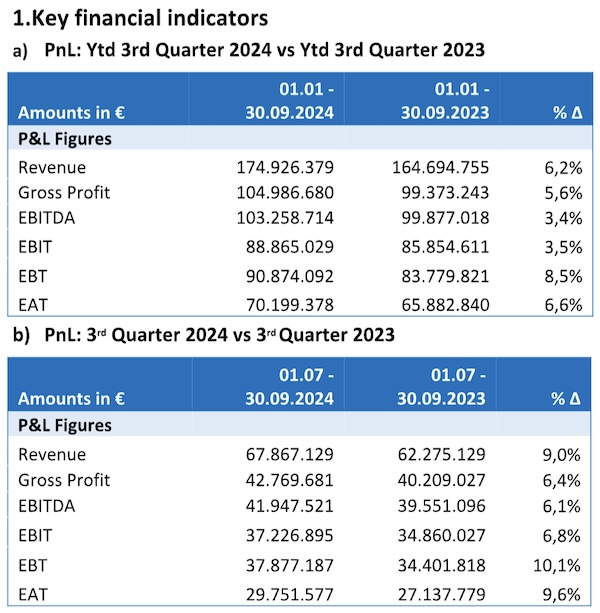

PPA SA: Basic Financial Results and Developments for the Third Quarter 2024 New Record levels of Revenue and Profits

PPA S.A. announces financial results for the third quarter of 2024, focusing on the financial performance and strategic developments which configures its growth.

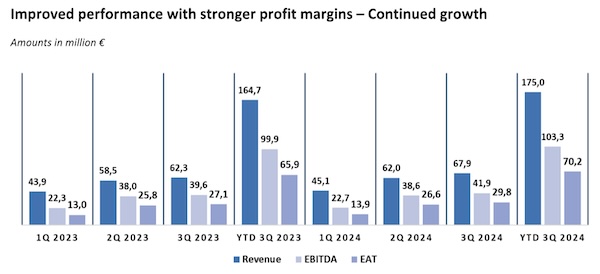

The Company continues its upward growth, achieving historically high performances that clearly reflect the successful implementation of its Management’s plans, despite the ongoing challenges which faces. More specifically, the main characteristics of the reported period are:

ü Significant improvement in revenues, which recorded a new historic high level

ü Effective management of expenses by keeping their change at a lower level than the increase in turnover

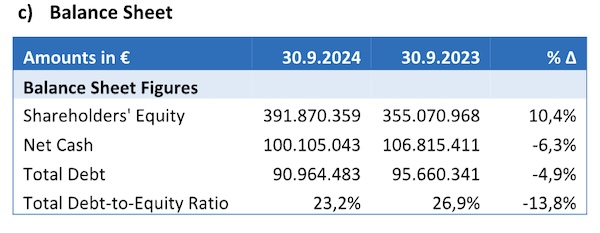

ü Impressive improvement of its profitability indicators, while maintaining its financial strength and strong liquidity

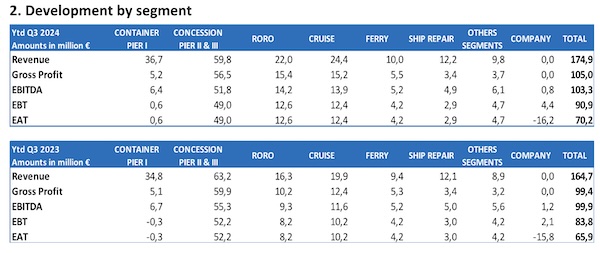

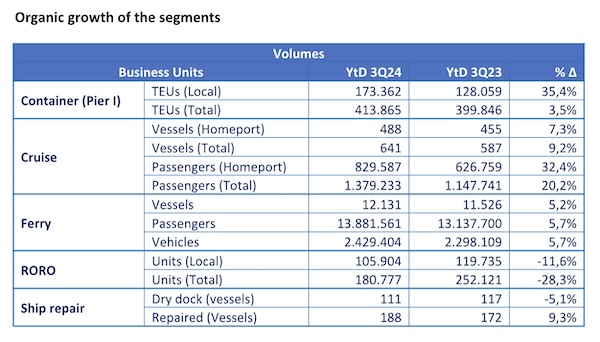

Revenues continued the upward trend of the previous period. At the forefront of this growth are the Cruise, Container and Car Terminal sectors, as well as Coastal Shipping. Revenue coming from the Concession of the Piers II & III, although they have been decreased in the 9month period due to the cancellation of ship itineraries through the Suez Canal, they had a positive change in the third quarter.

The improved results and profit margins reflect not only the improved revenue performance, but also the effective cost management policy implemented by the Company’s Management, which maintains it at an optimal level, despite the ongoing challenges of the energy crisis, the general inflationary economic environment, as well as increases in staff costs.

An increase in throughput compared to 2023 was recorded in most of PPA’s operational sectors.

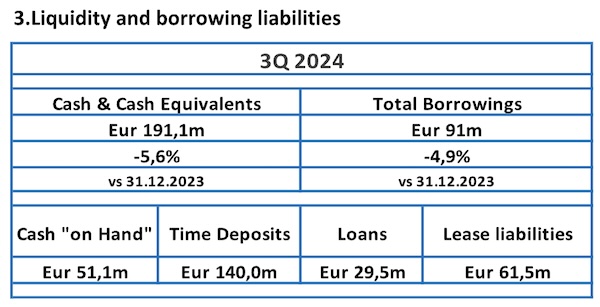

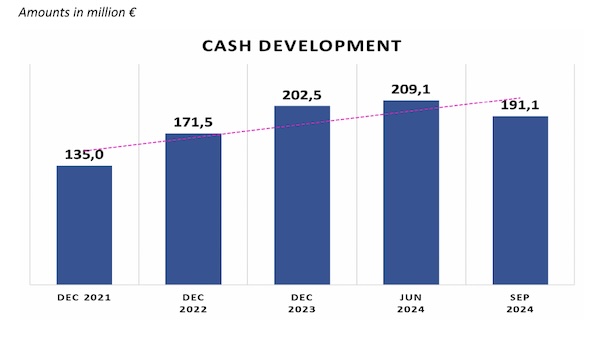

The company not only remains resilient to interest rate risks and unstable economic conditions but also makes effective use of its strong liquidity and emerging opportunities in the Greek market by investing in short-term time deposits, thus eliminating most of its risk exposure and enabling the smooth implementation of its huge investment plan and overall operation. The significant generation of positive cash flow and the low debt-to-equity ratio indicate the ability and stable growth of the company.

The total borrowing bank of the Company is significantly reduced, compared to 31.12.2023 due to the repayment of 2 installments of the current loans (total repayment amount of € 3.0 million).

The Company’s financial income, which is mainly derived from its investments in short-term term deposits, increased by € 2.8 million, compared to the same period last year (30.09.2024: € 4,0 million / 30.09.2023: € 1,2 million)

The Cash and cash equivalents clearly reflect its strong liquidity. It should be noted that the slight decrease in the balance during the current period is mainly due to the repayment of the dividend for the financial year 2023 of a total amount of € 33.4 million, which took place in August 2024.