OPEC: Tanker Market Showed Mixed Performance in May

The tanker market showed mixed performance during the month of May, but June is expected to be a completely different story. In its latest monthly report, OPEC said that dirty tanker spot freight rates saw mixed movements in May. Aframax and Suezmax rates experienced declines, while VLCC rates were flat to slightly lower. Suezmax spot freight rates on the US Gulf Coast to Europe route declined 22%, m-o-m, amid limited enquiries. In the Aframax market, spot freight rates on the Mediterranean-to-Northwest Europe route fell 20%, m-o-m, weighed down by softening supply-demand fundamentals.

On the Middle East-to-West and West Africa-to-East routes, VLCC spot rates were unchanged, m-o-m, while rates on the Middle East-to-East route slipped 2%. Ample availability combined with limited long-haul demand eroded market sentiment over most of the month. Spot rates in the clean tanker market were also mixed. East of Suez rates rose 4%, m-o-m, as tonnage lists tightened. West of Suez rates declined by 9%, m-o-m.

Dirty tanker freight rates

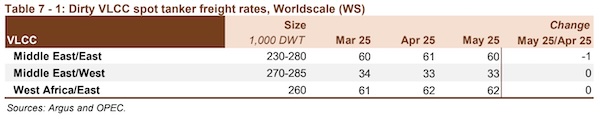

Very large crude carriers (VLCC)

VLCC spot freight rates were broadly stable, m-o-m, in May, although marginally softer rates on the Middle East-to-East route pushed down the overall average. VLCC spot freight rates slipped 2%, m-o-m, on average, and were down 15% compared with the same month last year.

On the Middle East-to-East route, rates averaged WS60 in May, representing a 2% drop compared to the previous month. Rates were 12% lower, y-o-y.

Spot freight rates on the Middle East-to-West route were unchanged, m-o-m, to average WS33. Compared with the same month in 2024, rates were down 25%.

On the West Africa-to-East route, spot freight rates were also unchanged, m-o-m, to average WS62. Compared with the same month in 2024, rates were down 11%.

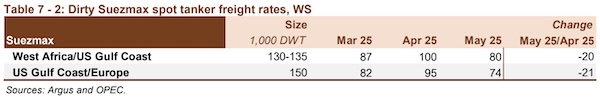

Suezmax

Spot freight rates for Suezmax vessels declined in May, falling 21% on average, m-o-m, and were down 17% from the previous year’s level. On the West Africa-to-USGC route, spot freight rates in May averaged WS80, representing a loss of 20%, m-o-m. Compared with the same month in 2024, spot rates on the route were 22% lower. Rates on the USGCto-Europe route erased the previous month’s gains, falling 22% to average WS74. Compared with the same month in 2024, rates were down 12%.

Aframax

Aframax spot freight rates saw the strongest declines among the monitored vessel classes in May. On average, Aframax rates fell 25%, m-o-m, and were down 27%, y-o-y. Rates on the Indonesia-to-East route fell 15%, m-o-m, to an average of WS116 in May. Y-o-y, rates on the route were down 31%.

Following a surge the month before, Caribbean-to-USEC spot freight rates fell 36%, m-o-m, to average WS135. Compared with the same month last year, rates were down 14%. Cross-Med spot freight rates fell 22%, m-o-m, to average WS138. Y-o-y, spot rates on the route were 32% lower. Meanwhile, rates on the Med-toNWE route declined 20%, m-o-m, to average WS137. Compared with the same month in 2024, rates were down 28%.

Nikos Roussanoglou, Hellenic Shipping News Worldwide