Newbuilding Orders Lacking Momentum | Hellenic Shipping News Worldwide

Amid the ongoing trade war between USA and the rest of the world, shipbuilding activity remain rather lackluster, with a lot of questions regarding Chinese yards still in play. In its latest weekly report, shipbroker Banchero Costa said that “in the container sector, the German company Peter Doehle exercised options for 2 x 8,400 teu carriers with dual fuel LNG propulsion at Guangzhou Shipyard, taking the order to a total of 5 vessels. The price of each vessel remained undisclosed and the deliveries are expected to start during mid/end of 2027 and finish during 1H2028. In the bulk segment, the Chinese shipyard Dalian Shipbuilding Industry secured an order from the Japanese N.Y.K. Bulk and Projects of one 33,000 dwt vessel designed to carry large modular equipment and other very large machinery. The price reported is $50 mln and the delivery is expected in mid/late 2027”.

Source: Xclusiv

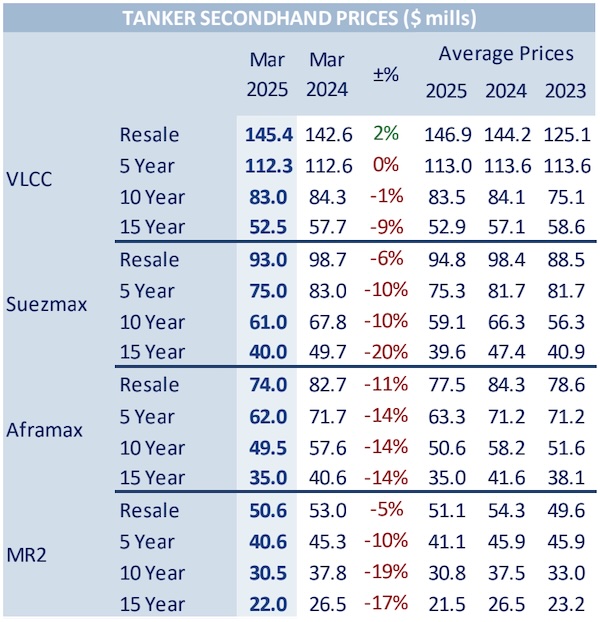

Meanwhile, in the S&P market, shipbroker Xclusiv said that “on the Cape Sector, the “Maran Odyssey” – 172K/2006 Daewoo and the “Maran Sailor” – 172K/2006 Daewoo were sold for USD 19 mills each to clients of GMS. Chinese buyers acquired the Supramax “Port Macau” – 59K/2008 Tsuneishi Zhoushan for high USD 11 mills, while the Scrubber fitted “Strange Attractor” – 56K/2006 Mitsui found new owners for mid/high USD 9 mills. On the Handysize sector, the “Fortune Hero” – 35K/2012 Huludao Bohai changed hands for USD 8.5 mills, while the “Tate J”- 34K/2012 SPP was sold for high USD 13 mills. In the tanker segment, “the VLCC segment was very active this week with 4 vessels finding new owners, with an average age of 21 years old. The VLCC “Wafrah” – 318K/2007 Hyundai Samho was sold for USD 40 mills. Moreover, the VLCC “New Naxos”- 300K/2003 Universal found new owners for region/mid USD 33 mills. On the LR2 sector, Chinese buyers acquired the “Southport” – 115K/2008 STX for USD 35 mills. On the Mr2 Sector, the “Challenge Procyon” – 46K/2011 Shin Kurushima changed hands for high USD 19 mills, while the 3-year older “Centennial Matsuyama” – 47K/2008 Onomichi was sold for mid USD 16 mills. The MR1 “Yash” – 37K/2002 STX was sold for USD 8.2 mills. Finally, the Small tanker “TTC Vishaka”- 18K/2012 Zhejiang Hangchang found new owners for USD 13.1 mills”, Xclusiv concluded.

Similarly, Banchero Costa said that “in the dry sector the ROSEMARY 179,000 dwt 2010 Daewoo built was sold at $25 mln. 2 weeks ago MOUNT SONG 180,000 dwt 2010 Koyo Dockyard Built was sold around $2,5 mln more. Always in the Cape segment MARAN ODYSEEY and MARAN SAILOR 171,000 dwt 2006 Daewoo were reported sold $19 mln each to GMS. The Kamsarmax ENERGY HOPE 82,000 dwt 2012 Tsuneishi built was purchased at region $17 mln. Similar vessel YM ENDEAVOUR one year older was reported sold at the beginning of the month at $14 mln. Chinese buyers were behind the purchase of the MAGIC ECLIPSE 74,000 dwt 2011 Sasebo built reported sold for $13,5 mln. SUNSHINE BLISS 76,000 dwt 2010 Oshima built was sold in January at $11,5 mln. KMARIN OSLO 63,000 dwt 2015 Jiangsu Hantong Shipbuilding was purchased from chinese buyersfor $22 mln. After offers were invited last week the Handysize SEASTAR MERLIN 39,000 dwt 2025 was reported sold around $33.2 mln to HMM.

Source: Banchero Costa

It was an active week also in the tanker market, reporting the sale of the VLCC DHT LOTUS 320,000 dwt 2011 Bohai built at $55 mln. The Suezmax PENTATHLON 158,000 dwt 2009 Samsung built was reported sold around $40,5 to undisclosed buyers. QUETTA and LAHORE both 107,000 dwt 2003 Japan Built (SS due 2029) were reported sold en-bloc at $36,25 mln, a very different price level compared to last month when a similar vessel, the SEA LUCK III 105,000 dwt 2003 Hyundai Samho built was sold at $25 mln. After offers were invited last week the Handysize tanker ALICE 37,000 2007 STX built was purchased by Turkish buyers at $9,0 mln. In the chemical sector SAEHAN INTRASIA 19,000 DWT 2005 Fukuoka built was sold for $15,1 mln to Chinese buyers”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide