With the summer holidays nearing their end, newbuilding activity has been picking up pace. In its latest weekly report, shipbroker Best Oasis said that “in the container sector, Canadian company Seaspan Corp. placed an order of 6 x 9,000 teu carriers to Chinese yard Hudong-honghua. No prices were disclosed, and deliveries are scheduled for Q3 2028. Chinese company Ningbo Ocean Shipping placed an order of 4 x 4,300 teu carriers to Chinese yard Huangpu Wenchong. The price for each vessel is $60 mil and deliveries are set to start Q2 2026 and finish late-2029. In the gas sector, Danish company Celsius Shipping placed an order of 2 x 174,000 cu.m. LNG carriers to Korean shipyard Samsung. The price for each vessel is $260.9 mil and deliveries are scheduled for late 2027. Samsung also secured an order for 3 x 174,000 cu.m. LNG carriers from Greek company TMS Cardiff Gas. One vessel is priced at $250 mil and the other two priced at $246.97 mil. Deliveries are set to start in Q2 2027 and finish Q3 2027. TMS Cardiff placed an order of 1 x 174,000 cu.m. LNG carrier to Korean yard Hyundai Samho. The price for the vessel is $246.97 mil and delivery is set for Q1 2028”, the shipbroker said.

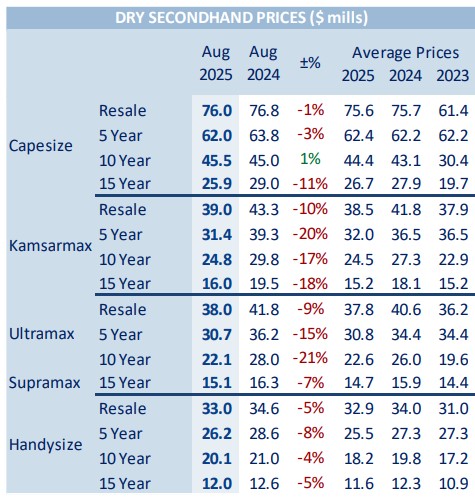

Source: Xclusiv shipbrokers

Meanwhile, in the S&P market, shipbroker Xclusiv commented this week that “the dry S&P activity was high for one more week. On the Capesize sector, the Scrubber fitted “Pacific South” – 176K/2012 Jiangsu Rongsheng was sold for USD 22.75 mills to undisclosed buyers, while Greeks acquired the “Frontier Bonanza” – 179K/2010 HHI for USD 26.2 mills. In the Kamsarmax sector, the Scrubber fitted “Darya Shanti” – 82K/2016 Jiangsu Newyangzi changed hands for USD 22.3 mills to Chinese buyers. On the Panamax sector, the “Navios Hope” – 75K/2005 Universal was sold for USD 8.5 mills to undisclosed buyers with SS/DD freshly passed.

Moving down to the Supramax sector, Malaysians acquired the “Moana Baq” – 57K/2012 Qingshan for USD 13.25 mills, while the “African Jacana” – 59K/2012 NACKS was sold for low USD 16 mills to undisclosed buyers. Greeks were also active in the Ultramax/Handy sectors, acquiring the “Beauty Lotus” – 64K/2015 China Shipping for USD 21 mills and the “Aston Trader” – 39K/2017 Jiangmen Nanyang at an undisclosed price. Finally, on the Handymax sector, Chinese buyers acquired the “Atilla” – 38K/2011 Samho for USD 13.2 mills”.

In the wet segment, “on the VLCC sector, the Scrubber fitted “Searacer” – 297K/2009 Dalian was sold to Chinese buyers for high USD 40 mills. Additionally, the Scrubber fitted sisters “Bunga Kasturi Enam” – 299K/2008 Universal and “Bunga Kasturi Lima” – 300K/2007 Universal were sold enbloc to Chinese buyers for USD 88 mills. In the Aframax/LR2 sector, the LR2 “Pacific Sky” – 115K/2009 STX changed hands to Chinese buyers for USD 32 mills. Finally, on the MR2 sector, Greeks acquired the Scrubber fitted “STI Maestro” – 47K/2020 Hyundai Vietnam for USD 42 mills”, Xclusiv concluded.

Source: Xclusiv shipbrokers

Similarly, Best Oasis added that, “in the bulk sector, the newcastlesmax MINERAL UTAMORO 207,000 dwt 2016 Imabari built was reported sold with sisters MINERAL EDO (2015) and MINERAL HOKUSAI (2015) to clients of Asyad Shipping at $165 mil enbloc. In the capsize segment, FRONTIER BONANZA 180,000 dwt 2010 Hyundai built was reported sold to Greek interests at $26.2 mil. In the post-panamax segment, AFEA 88,000 dwt 2006 Imabari built was reported sold at $10.85 mil. In the panamax segment, NAVIOS HOPE 75,000 dwt 2005 Universal built wasreported at $8.5 mil. In the supramax segment, SAGAR SHAKTI 58,000 dwt 2012 Tsuneishi Zhoushan built was reported sold to Greek interests at $14.6 mil, while MOANA BQ 57,000 dwt 2012 Qingshan built was reported sold to clients of Lianson Fleet Group at $13.25 mil. The handymax vessel ROSTRUM ASIA 40,000 dwt 2021 YZJ was reported sold at $25 mil. In the handysize segement, Greek interests were behind the purchase of ATILLA 37,000 dwt 2011 Samho built at $13.2 mil. Additionally, SEA SAPPHIRE 32,550 dwt 2010 Zhejiang built was reported sold at $8.5 mil”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide