Newbuilding Activity Takes a Breather During 2025

Newbuilding contracting activity has taken a step back so far in 2025, especially when compared to the past couple of years. In its latest weekly report, shipbroker Xclusiv said that “the first half of 2025 has marked a distinct departure from the aggressive newbuilding momentum witnessed over the last two years, as owners across all major shipping sectors exhibit a more restrained approach to ordering. This shift is evident in the stark drop in global newbuilding orders across Dry, Tanker, and Gas segments, with only the Container sector bucking the trend. While macroeconomic and regulatory uncertainties weigh heavily on sentiment, the prevailing driver seems to be the sobering reality of high prices and freight market underperformance”.

Source: Xclusiv

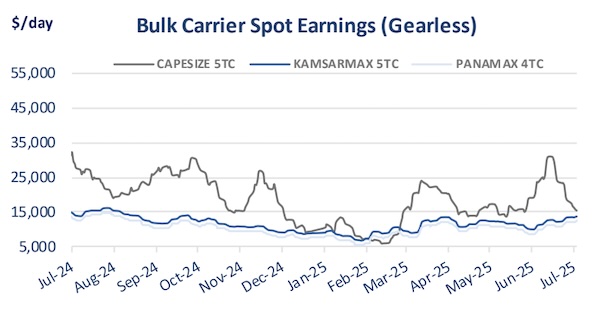

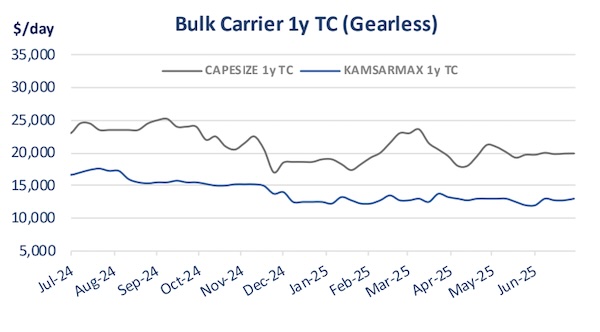

According to the shipbroker, “in the dry bulk sector, owners appear to have hit the brakes hard. From January to June, just 76 newbuilding contracts were recorded—down sharply from 355 during the same period in 2024. Greek shipowners, traditionally dominant in this space, have essentially withdrawn, placing just three dry orders compared to 30 in the previous year. This pullback comes as little surprise given the persistently weak earnings environment. The Baltic Dry Index remains anchored near multi-year lows, squeezed by China’s economic underperformance and tepid demand for core commodities such as iron ore and coal. Newbuilding prices, meanwhile, remain elevated, discouraging further investment—especially in a market already burdened by mounting fleet supply. With over 1,600 bulk carriers scheduled for delivery from 2024 through 2027, owners are likely weighing the growing risk of oversupply in a market with little pricing power.

The tanker segment follows a similar, albeit more geopolitically charged, narrative. Global tanker orders in H1 2025 fell by nearly 80% year-on-year, from 486 to 102 units, with Greek orders sliding from 100 to 32. While this mirrors the broader cooling in sentiment, the tanker landscape remains clouded by heightened volatility. Product tanker earnings in the Pacific have faltered, and ongoing disruptions in the Red Sea, coupled with mounting geopolitical risks involving Iran and Ukraine, have cast long shadows over the market’s stability. The regulatory fog surrounding decarbonization further compounds the issue. With no clear consensus on future propulsion and fuel technologies, many owners are opting to defer capital commitments until more clarity emerges”.

Source: Xclusiv

Meanwhile, “in the gas segment, the slowdown is more a pause than a retreat. Following the LNG newbuilding boom of 2023–24, driven by Europe’s frantic diversification from Russian gas, many owners are simply digesting their recent investments. Only 44 gas carrier orders were placed globally in H1 2025, down from 158 the previous year, with Greek activity falling to just five units. But this moderation may be as much about limited yard capacity as it is about cautious sentiment. Shipyards specializing in LNG are now booked into 2028 and beyond, pushing delivery timelines out of sync with commercial cycles. Moreover, the waning availability of long-term charter coverage for new projects makes speculative investment increasingly difficult to justify. Curiously, the only sector to show growth has been containers. Global boxship orders rose to 201 in H1 2025, from 170 a year ago, with Greek owners doubling their participation. This renewed interest seems to reflect both decarbonization imperatives and a scarcity of modern secondhand assets. Owners are prioritizing dual-fuel, eco-designed newbuildings to future-proof their fleets against regulatory headwinds. Also supporting this rebound is the availability of delivery slots for feeders and midsize units—unlike gas and tanker sectors, where shipyard bottlenecks persist”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide