Middle East Tensions Further Hurt Ship Recycling Activity

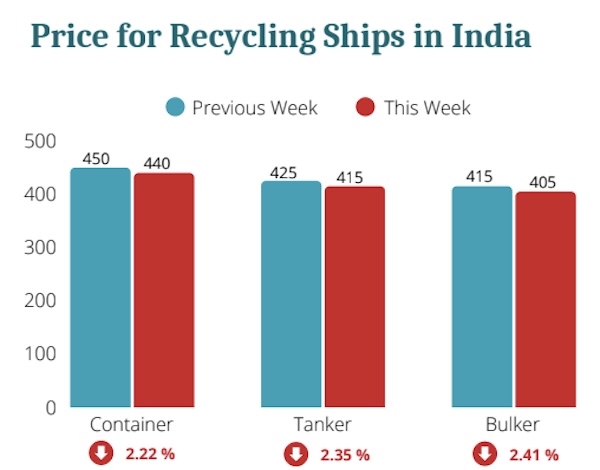

The ship recycling market was further hampered by the developments of the past week and the escalation of warfare between Iran and Israel. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “the ship recycling market enters the week on a subdued note, with most regions seeing limited activity and cautious sentiment. India remains quiet as buyers hold off, waiting for prices to align with their expectations, while Bangladesh stays inactive due to the Eid holidays and growing focus on the upcoming enforcement of the Hong Kong Convention. Pakistan shows relatively more interest, but currency issues are dragging out deals and limiting the pace of deliveries. Turkiye stays stable but flat, with little movement as buyers remain hesitant amid broader economic concerns. The looming HKC is beginning to influence short-term decision-making across markets, prompting many to step back and reassess. While India stands to benefit longer-term thanks to its existing compliance and infrastructure, the overall market remains in wait-and-watch mode, with few signs of a near-term pickup unless pricing or regulatory clarity improves.

Source: Best Oasis

According to Best Oasis, “global shipping is on edge as Israel launches strikes on Iranian targets, pushing regional tensions into dangerous territory. The Strait of Hormuz remains open, but with Iran’s record of targeting tankers, risk levels are climbing fast. United Kingdom Maritime Trade Operations (UKMTO) is urging vigilance and some ships are already rerouting. Any move by Iran to choke oil flows could push crude prices well past triple digits. For now, cargo keeps moving but the risk of unintended escalation is growing. The World Bank has cut its global growth forecast for 2025 to 2.3%, the slowest pace in years outside of recessions. Weighed down by trade tensions, inflation, and policy uncertainty, major economies like the U.S., China, and the EU face downgraded outlooks. The warning signals a challenging path ahead, especially for developing nations already struggling with poverty and limited fiscal space”, the report concluded.

Meanwhile, shipbroker Intermodal commented that “it was a sluggish week for the ship recycling sector amid Eid holidays, with limited buying interest, affected by concerns over steel tariffs in India and uncertainties related to the post-HKC landscape in Bangladesh and Pakistan. In India, the market remained subdued as the gap between prevailing price levels and buyer expectations continues to hinder fresh acquisitions. Local steel prices have extended their decline, impacted by global tariff tensions, particularly those originating from the US. Notably, the recent increase in US tariffs on steel imports from 25% to 50% has raised concerns among Alang recyclers about a renewed influx of low-cost Chinese steel into the domestic market. Such a development could further depress local steel prices and constrain recyclers’ ability to offer competitive prices for incoming vessels. Meanwhile, the industry is ready for the impending enforcement of the HKC, with growing confidence that local sector’s compliance and recycling infrastructure will position Indian shipyards to secure a greater share of end-of-life tonnage going forward. Bangladesh witnessed a dormant week, as Eid holidays brought industrial operations, including ship recycling in Chattogram, to a near standstill.

Source: Intermodal

Monsoon-related disruptions and ongoing efforts to meet HKC compliance further impacted activity, with many yards fast-tracking upgrade works. The restrictions on issuance of NOCs, leaving several vessels (previously sold to non-HKC-compliant facilities) anchored off port limits awaiting clearance. Buyers appear to be in a holding pattern, with firmer interest expected to return after June 26th, when HKC comes into force. Pakistan’s ship recycling sector continues to face headwinds, with uncertainty mounting ahead of HKC enforcement. Currently, no yards in Gadani are certified, although seven are in the process of becoming compliant. The limited window to complete necessary infrastructure upgrades puts the country at risk of losing ground versus its subcontinent neighbors. While authorities have taken initial steps, such as mandating Inventory of IHMs and proposing tax incentives, progress has been slow. Ongoing foreign exchange constraints and the absence of certified facilities continue to suppress buying interest and weigh on the market outlook. Pakistan may regain competitiveness if compliance efforts accelerate, but for now, it remains in a reactive and transitional phase. In Turkey the ship recycling market was quiet, with economic uncertainty weighing on market sentiment and buyers adopting a wait-and-see approach”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide