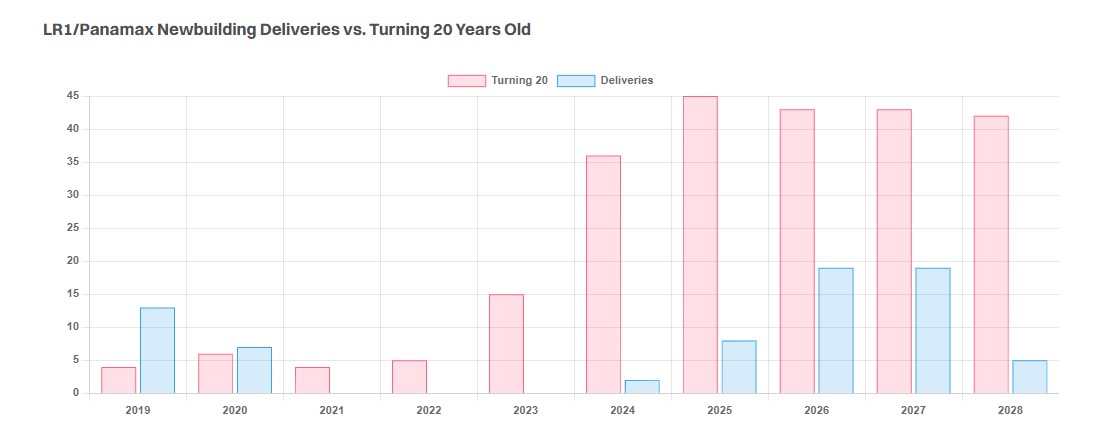

LR1/Panamax Market Expected to Benefit from Ageing Fleet

An ageing fleet is expected to favor future prospects of the LR1/Panamax market. In its latest weekly report, shipbroker Gibson said that “the LR1/Panamax market has often been referred to as a dying sector, with investment in new tonnage close to zero for many years. Overall, just 9 vessels in the class were ordered from 2016 to 2022. Demand has also faced headwinds, with clean LR1 tonne miles down marginally and dirty Panamax trade seeing significant declines. Despite the challenging demand fundamentals, an ageing fleet has encouraged investment in the sector, with further newbuilding contracts likely. However, with threats from the Aframax, LR2 and MR sector, it is uncertain what level of investment is required to meet future demand”.

According to Gibson, “over the last 5 years, tonne miles for clean LR1s have declined by 2.5%, whilst dirty Panamaxes have seen a 42% contraction. By contrast, clean LR2s have benefitted from a near 29% increase and Aframaxes have witnessed an 18% jump in tonne miles. Evidently the LR1/Panamax sector is being left behind by demand growth for other sectors with numerous factors driving this trend”.

Source: Gibson Shipbrokers

Meanwhile, “the expansion of refining capacity East of Suez and corresponding contraction in the West has tended to favour LR2s, which typically offer better economies of scale. This trend in long haul products trade has also been amplified by supply chain disruptions following the war in Ukraine. From a port infrastructure perspective, analysis of the top 20 ports visited by LR1s shows that restrictions are not a major driver, meaning that LR1s have few captive markets. Despite this, total LR1 CPP volumes in their core Middle East and India markets have remained steady over the past 5 years, with most of the downwards pressure coming from the Far East and Northern Europe due to changes in the refining landscape”.

Gibson added that “changes to vacuum gasoil and fuel oil flows have shifted demand away from Panamaxes in recent years, whilst the expanded Panama Canal has meant Aframaxes are more competitive in reaching the US West Coast. Port improvements have also seen market share lost in the US Gulf market. At the same time, refining changes in Europe have crimped dirty product exports on Panamaxes from the region. However, demand for this size in Latin America has remained resilient, and currently generates more than 60% of total tonne mile demand”.

The shipbroker concluded that “despite challenging demand fundamentals, the supply side outlook remains supportive with the number of vessels turning 20 years old far exceeding those being delivered. By the end of this year, 16.5% of the fleet will be >20 years old, with another 33% turning 20 between now and 2028. Based on the current orderbook and zero scrapping, Gibson estimates that 49.5% of the fleet with be >20 years old by 2028. Whilst cannibalisation from other sizes remains a threat, demand is unlikely to decline by the same degree, warranting further investment in the sector”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide