LNG Shipping: US Exports Rose Strongly During the First Quarter of 2025

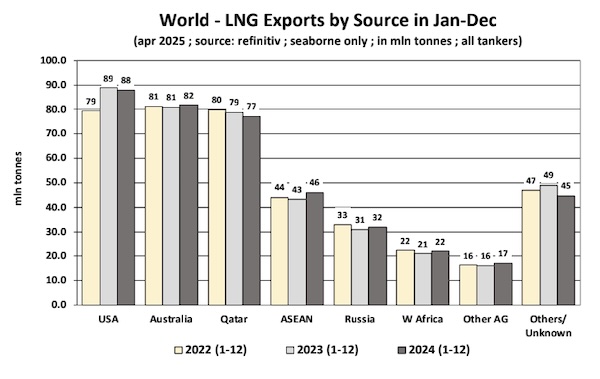

US LNG exports rose strongly during the first quarter of 2025. In its latest weekly report, shipbroker Banchero Costa said that “global seaborne LNG trade was increasing sharply until 2022, helped also by the events in Ukraine which forced Europe to diversify away from Russian pipeline gas. The last two years, however, have seen a significant slowdown in the growth levels. In Jan-Dec 2023, global shipments of LNG increased by just +1.4% y-o-y to 408.7 mln t, based on LSEG vessel tracking data. In Jan-Dec 2024 there was no growth at all, with shipment volumes flat +0.0% y-o-y at 408.8 mln t. In the first quarter of 2025, global LNG shipments increased by a still relatively modest +2.6% y-o-y to 108.9 mln tonnes, from 106.1 mln t in the same period of 2024”.

According to the shipbroker, “the largest exporter of LNG is now the USA, which accounted for 24.0% of shipments in Jan-Mar 2024, followed by Qatar with 19.8%, Australia with 18.2%, South-East Asia with 11.5%, and Russia with 7.4%. In Jan-Mar 2025, the USA exported 26.1 mln tonnes of LNG, which represented a +15.2% y-o-y increase from the 22.7 mln t shipped in 1Q24. Qatar exported 21.5 mln tonnes in Jan-Mar 2025, up +7.0% y-o-y. Australia shipped 19.8 mln tonnes in Jan-Mar 2025, down -6.4% y-o-y. From South East Asia shipments increased +5.0% y-o-y to 12.6 mln t. Russia shipped 8.0 mln tonnes of LNG in 1Q 2025, down -1.7% y-o-y and the lowest volume since 2021”.

Source: Banchero Costa

Meanwhile, “the European Union remains the world’s largest importer of LNG. In Jan-Mar 2025, the EU imported 25.5 mln tonnes of LNG, up +9.6% yo-y, accounting for 23.3% of global LNG imports. The United Kingdom imported 4.5 mln tonnes of LNG in Jan-Mar 2025, up +37.9% y-o-y from 3.3 mln t in 1Q24 but still below the 6.1 mln t in 1Q23. Japan imported 18.5 mln t in 1Q25, up +2.2% y-o-y, and now accounts for 16.9% of global imports. China imported 15.5 mln tonnes of LNG in 1Q25, -23.3% y-o-y from 20.3 mln t in 1Q24, and now accounts for 14.2% of global imports”, the shipbroker said.

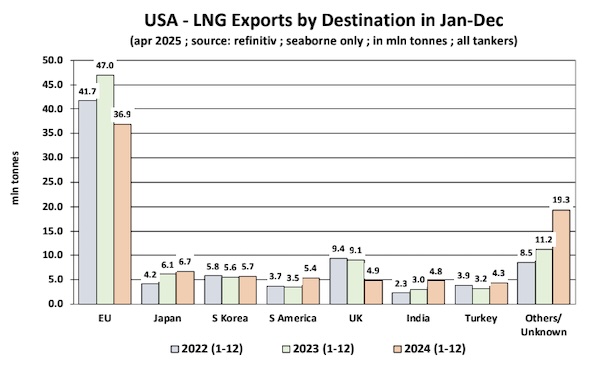

According to Banchero Costa, “the USA are now emerging at the forefront of global LNG exports. Still in 2022, the USA were the third largest exporter of LNG after Australia and Qatar, with a 19.7% share of global export volumes. Volumes have been increasing strongly for many years now. In 2021, exports from the USA increased by a massive +50.3% y-o-y, whilst in 2022 growth was +9.5% yo-y, in 2023 it was +11.8% y-o-y. In Jan-Dec 2024 things were more disappointing, with exports from the USA down by -0.9% y-o-y to 87.9 mln tonnes. However, they were still the world’s top exporter with a share of 21.5% of global shipments. Top LNG loading ports in the United States in 2024 were: Sabine Pass (29.9 mln t in Jan-Dec 2024), Corpus Christi (14.9 mln t), Freeport (12.8 mln t), Cameron (9.5 mln t), Cove Point (5.1 mln t)”.

Source: Banchero Costa

“In terms of destinations for American LNG, the main routes are now transatlantic to the EU and UK, although there has been a correction since the peak in 2022-2023. In Jan-Dec 2024, LNG exports from the USA to the European Union declined by -21.4% y-o-y to 36.9 mln tonnes from 47.0 mln t in 2023. The EU is now the destination for 42.0% of the USA’s total LNG exports in Jan-Dec 2024. Volumes to the UK also dropped by -46.8% y-o-y to 4.9 mln t in 2024, from 9.1 mln t in 2023. The UK was the destination for 5.5% of US LNG shipments last year. Outside Europe, the top destination is Japan, which accounted for 7.6% of USA LNG shipments in 2024. Shipments from the USA to Japan increased by +9.3% y-o-y last year to 6.7 mln tonnes. Shipments from the USA to Mainland China increased last year by +31.9% y-o-y in 2024 to 4.3 mln tonnes, however China still accounts for just 4.9% of US LNG exports”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide