Landmark Week Ahead For Ship Recyclers

The tension surrounding the US attack on Iran saw the Baltic Exchange Dry Index (BDI) fall a massive 3.5% down to its lowest level seen over the last two weeks, erasing most recent gains as Friday closed, reports cash buyer GMS. Leading the race was the Capesize index that fell nearly 6.5% across the week while the Panamax index fell 0.2% during the same time.

“The price of oil, which will also be a key item to keep an eye out for next week especially as the Iranian government votes to shut down the Gulf of Hormuz effectively terminating Iranian oil exports, had already fallen about 0.2% (seems to be a theme here) to end the week at USD 73.80/barrel,” says GMS. “Global markets immediately started reacting post-strikes as the U.S. dollar, having ended Friday overall stronger than most recycling nation currencies, saw the ‘Weekend at Bernie’s’ volatility push the U.S. Dollar all over the currency board.”

Local steel plate prices also continued along the same trajectory as recent weeks i.e. down in some while lying on the beach in others.

“And while these seismic shifts are not without reverberations that have already been felt all over the Indian sub-continent ship recycling sector, the upcoming enforcement of the Hong Kong Convention (HKC) exacted a self-imposed, yet much-needed set of restrictions to ensure that the business of recycling endures at key locations.”

Price declines that started recently will also continue across an already creaky Indian sub-continent ship recycling sector, which itself is going through a tonnage drought on the back of recently firming freight rates despite recycling markets suffering through one of the worst supplies of recycling tonnage in 2024 in over a decade, all while global ship recyclers were bracing (hoping?) for a healthy inflow of vessels in 2025.

Much of this backlogged tonnage is still expected to come for recycling as owners have delayed the sale of some over-aged units because these vessels continue to earn decent rates amidst disastrous geopolitical events that continue to strike the global economy and keep freight markets more than buoyant, says GMS.

“As tonnage remains absent from the bidding tables, for anxious ship recyclers, Trump’s incessant hopscotching over tariffs and changing trade policies now blended with a fresh new conflict in the Middle East will make it difficult to predict which way the winds will blow (where currencies and local steel plate prices are concerned) and just where subsequent offers will end – tea leaves anyone?”

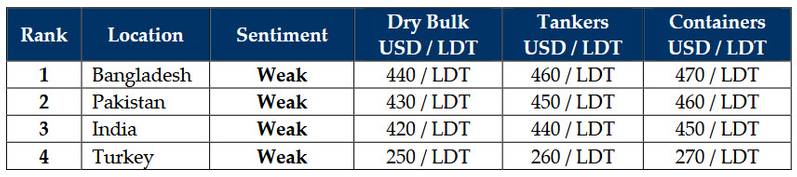

GMS demo rankings / pricing for week 25 of 2025 are: