Kpler, the commodities and data analysis firm, has calculated that Iran’s stock of crude oil held afloat has increased from 5 to 35 million barrels between January and July this year, with the volume held on tankers now estimated to be 40 million barrels.

Iranian Oil Minister Mohsen Paknejad, when challenged over similar figures published by Bloomberg and S&P Global Platts, responded that “we fundamentally have no oil that we are unable to sell.”

Kpler bases its calculation on the difference between oil exported from Iranian terminals, and oil unloaded in Chinese ports. Almost all Iranian crude is sold to China. Kpler uses satellite imagery to conduct this analysis. Other commodity intelligence firms calculate higher numbers for the floating stock held on dark fleet tankers, with Vortexa estimating the stock afloat now amounts to 63 million barrels.

Estimates of the quantities involved also draw on export data from Malaysia, which apparently averaged 1.4 million barrels per day of oil exports to China in 2024, while its own production, mostly from Sabah and Sarawak, is only about 500,000 barrels per day. China in the meantime officially records no imports from Iran. This statistical discrepancy is explained by the transshipment of oil from tankers ex-Iran offshore Malaysia. The stock of oil then held afloat is largely kept off the east coast of Malaysia and off Dongying in northern China.

The build-up of stocks offshore is likely a consequence of the increasing reluctance of importers of sanctioned Iranian oil – whatever its designation of origin – to continue purchasing, having already over-stocked their tank farms ashore in anticipation of the sanctions tightening.

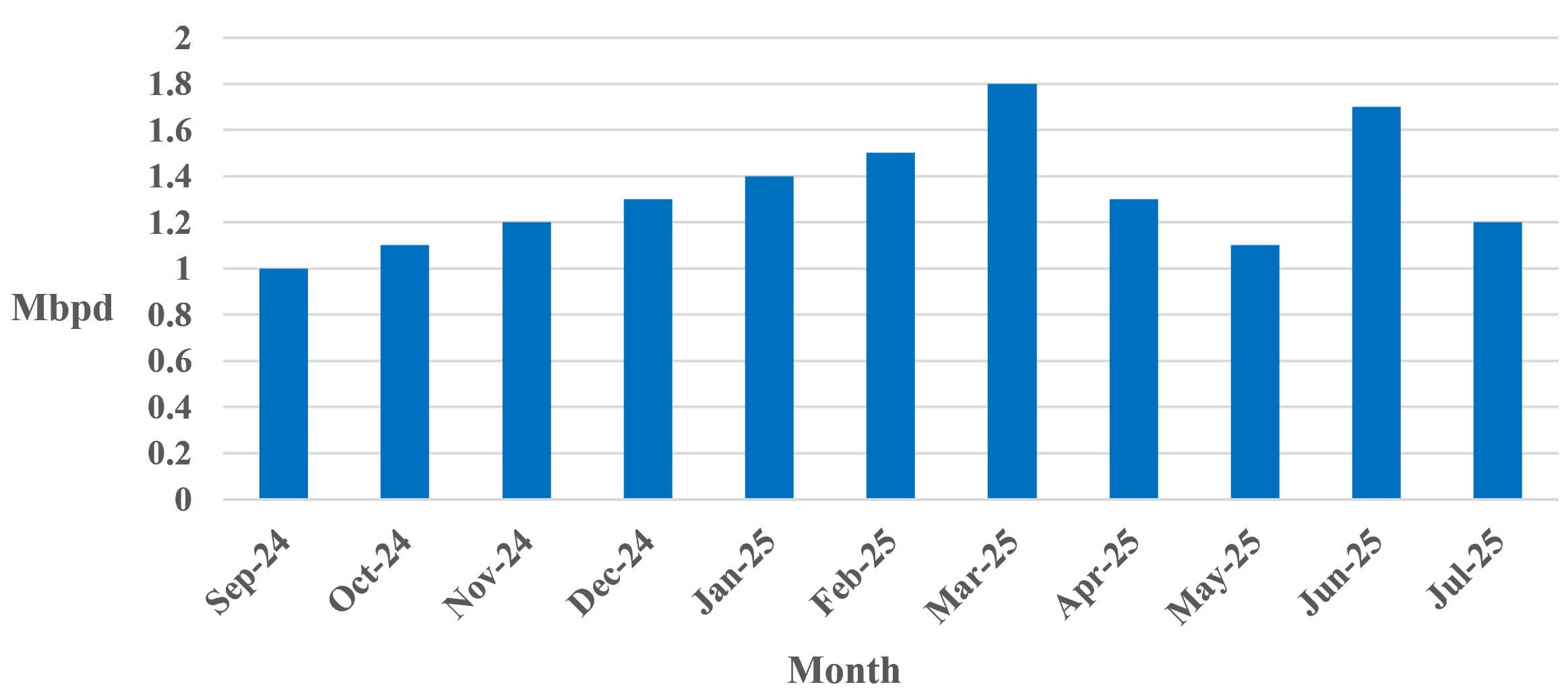

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)

Iranian crude exports to China derived from Kpler and Vortexa analysis (CJRC)

Enforcement of sanctions is apparently therefore becoming more effective, in part because those providing shipping services, as well as the ships, managers and shipowners, are now being targeted. Besides reducing volumes, sanctions avoidance also imposes additional costs on Iran as the seller, and increased discounting is necessary to shift undelivered cargos. A surge in Chinese imports in June has been attributed to Chinese teapot oil refiners stocking up in advance of tighter sanctions enforcement, but their holding capacity ashore is now full.

Malaysia’s Ministry of Investment, Trade and Industry announced in May that it would be taking more aggressive enforcement action against certification of origin frauds and transshipments taking place off Malaysia. But even if there is a will to take action, which is not really apparent, the legal authority to interrupt transshipment activities taking place in Exclusive Economic Zones is limited. Other countries such as Denmark are utilizing non-compliance with health, safety and insurance requirements to challenge dark fleet operations; certainly the concentration of full, uninsured, old and poorly maintained tankers off the Malaysian coast does pose an environmental risk.