Global Gas Report 2024 – SAFETY4SEA

The International Gas Union announced the release of the Global Gas Report 2024, produced in partnership with Snam and Rystad Energy.

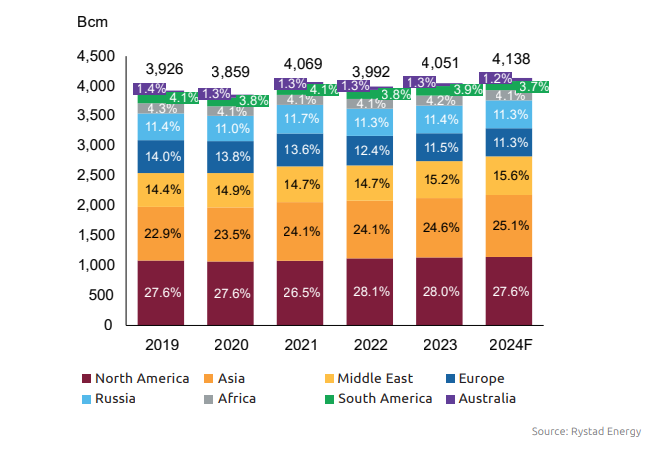

According to the report, global gas demand sustained its growth in 2023, increasing 59 Bcm (1.5%) from 2022. This trend is expected to continue in 2024 with a further estimated ~87 Bcm (2.1%) rise in demand. Asia’s strong demand growth continues to drive growth in global gas imports, while growth in exports from North America and the Middle East have been in the driving seat of the global supply growth.

Although global gas markets have stabilised from record volatility and prices seen in 2022, they remain fragile as concerns about energy security persist. As 2023 became another record emissions and coal use year, it is important to highlight that shifting from coal to natural gas is a readily available, cost-effective, and affordable way to cut emissions by around 50% immediately. It is crucial to emphasize that this step should be taken alongside, not instead of, ongoing efforts to expand renewable energy, enhance efficiency, and scale up all emission-free energy sources that are technologically and economically viable.

As informed, Rising Energy Demand in All Regions and Underinvestment in Gas and Clean Energy Jeopardise Global Energy Supply, with 2030 Energy Targets Visibly Out of Reach.

Global gas demand sustained its growth in 2023, increasing 59 Bcm (1.5%) and is expected to continue growing in 2024 with a further ~87 Bcm (2.1%) increase in demand.

In 2023, consumption increased in several regions, with Asia up by 32 Bcm (3.3%), the Middle East by 28 Bcm (4.7%), and North America by 14 Bcm (1.2%), outpacing a fall in consumption in Europe by 31 Bcm (-6.3%) and in Australia by 2 Bcm (-3.7%). In 2024, demand growth is expected to continue to be driven by Asia, up by ~43 Bcm (4.3%), the Middle East, up by ~29 Bcm (4.7%), and North America, up by ~8 Bcm (0.7%).

Global gas production also grew, rising 19 Bcm (0.5%) in 2023 relative to 2022 levels and is expected to continue growing in 2024, with supply increasing by ~96 Bcm (2.4%).

Growth in 2023 is largely attributable to increases in North America by 52 Bcm (4.3%), the Middle East by 16 Bcm (1.9%) and Asia by 3 Bcm (0.8%), offsetting a supply decline in Europe of 18 Bcm (-7.8%). Growth in 2024 is expected to be driven by the Middle East by ~26 Bcm (3.7%), Asia by ~17 Bcm (2.4%) and North

America by ~12 Bcm (1.0%). Modest growth is also expected from South America with an additional ~4 Bcm (2.6%) of production increase, alongside Europe by ~2 Bcm (0.9%), Australia by ~1 Bcm (0.7%) and Africa by ~1 Bcm (0.5%).

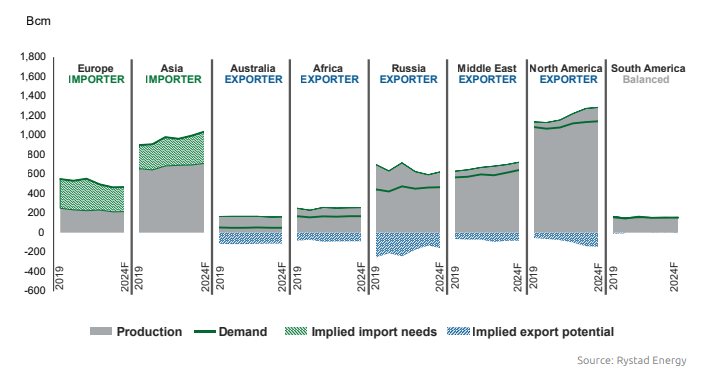

Asia continues to drive import demand growth globally, with North America and the Middle East growing exports to balance global supply and demand.

Implied import needs in Asia climbed by 29 Bcm (10.5%) in 2023 year-on-year, as countries like China boost gas consumption, a trend expected to continue into 2024. In contrast, European demand fell due to reduced demand from the power and industrial sectors, as well as lower seasonal needs. This coincided with higher renewable and nuclear power generation. Implied import needs in Europe fell by 14 Bcm (-5.2%) in 2023 and are expected to remain flat in 2024. North America’s export potential jumped by a notable 37 Bcm, as shale gas production boomed in the Permian, Haynesville and Eagle Ford plays, outpacing consumption. This trend is expected to soften in 2024, with some reversal of import potential growth. South America will continue to see a balanced market into 2024, as demand and supply match at continent level.

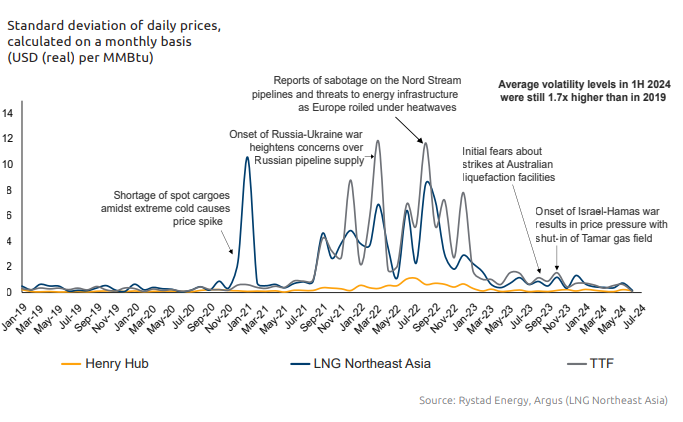

Global gas markets remain fragile. While global gas markets have calmed down from record volatility in 2022, they remain fragile as energy security concerns persist.

Volatility levels remain above their levels during the pre-pandemic era. This is evident from market reaction to the Israel-Hamas war beginning in October 2023, and from implied Title Transfer Facility (TTF) volatility levels – as seen in the chart above – being 1.7x higher in the first half of 2024 relative 2019 (full-year) levels. Gas prices have also lowered since, especially in Europe, though they remain sensitive due to tight balances, with no major new supply additions expected to come online in 2024. Any significant shift in demand or supply has the potential to disrupt the current balance in place.

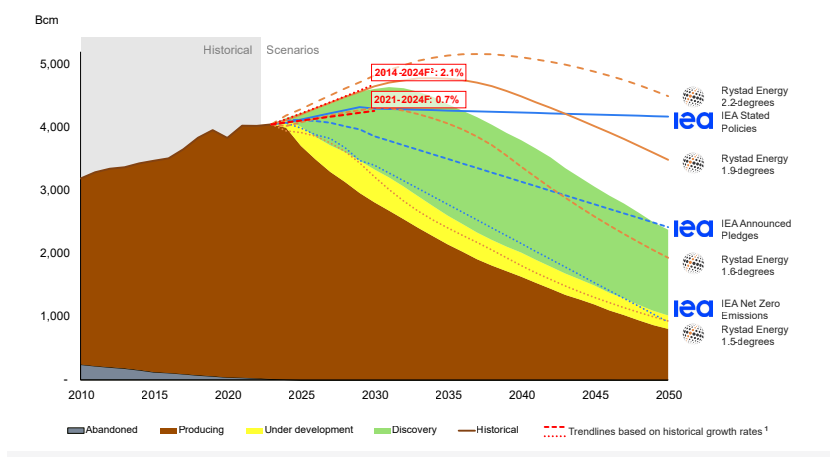

Current levels of investment in natural gas supply are insufficient to meet the demand trend towards 2030.

The historical trend of gas demand growth from economic development and improving living standards in the developing world, alongside new consumption trends and continued growth in energy use in the developed world, are keeping gas demand strong, while producing capacity and infrastructure investment are not keeping pace. The 2021-2024F gas consumption trendline on the chart shows a growth rate of 0.7%, in contrast with the demand decline trend assumed in the IEA’s APS, NZE and Rystad Energy’s 1.5-degree scenarios.

The longer 2014-2024F growth rate of 2.0% further departs from the IEA’s STEPS and Rystad Energy 1.6-degree scenarios. If the more conservative trend of gas demand growth between 2021-2024F continues to 2030, and no new producing capacity is added, the gap in supply of around 927 Bcm (22%) is expected in 2030. When considering trendline from 2014-2024F, this gap increases to around 1300 Bcm (29%) in 2030, showing the extent to which supply needs to be scaled up if imbalances between gas demand trajectory and investments in gas production and infrastructure are not tackled. The world finds itself in a period of high energy uncertainty in 2024, and prudent policy to reconcile scenario assumptions with current trends will be essential to manage this uncertainty and ensure timely investment in needed supply resources. It is essential to balance current growth and development trends with long-term sustainability goals to effectively reduce emissions, while maintaining secure, reliable, and affordable energy systems.

Global biomethane production is gaining momentum, with new centres of production emerging beyond the traditional market leaders of the EU and the US.

Biomethane offers a non-fossil renewably produced alternative to natural gas, which can be injected into existing natural gas infrastructure and used in the same way. Given that biomethane is often produced by capturing waste biogas from different parts of the economy, it has a high circular economy value.

Biomethane production in the EU grew rapidly at an annual rate of 24% from 2019 to 2022; however, to deliver on the EU’s 2030 target of 35 Bcm, this pace needs to be accelerated to 36% from 2023 to 2030. North America continues to be another leader in biomethane production, and positive momentum has also been spreading to emerging production markets in China and India.

The current production levels of biomethane still remain significantly under their commercial potential, and this is a readily available opportunity to reduce global energy emissions that should be capitalised on. Supporting policy will continue to play an important role, including removing barriers, creating an incentivised environment to connect producers to existing natural gas grids to accelerate the adoption of biomethane, and facilitating efficient distribution and enabling economies of scale.

EXPLORE MORE HERE