EU Iron Ore Imports on the Rise in 2024

EU iron ore imports have risen so far in 2024. In its latest weekly report, shipbroker Banchero Costa said that “2023 was a very positive year for global iron ore trade. In Jan-Dec 2023, global loadings of iron ore increased by +5.1% y-o-y to 1,631.9 mln tonnes, from 1,552.2 in the same period of 2022, based on AXS Marine vessel tracking data. The trend remained positive in JanOct 2024, with loadings growing by +3.0% y-o-y to 1383.2 mln tonnes. Exports from Australia increased marginally by +0.9% y-o-y in Jan-Oct 2024 to 767.0 mln tonnes. From Brazil, exports surged by +7.0% y-o-y in Jan-Oct 2024 to 315.3 mln t. From Canada there was a +3.6% y-oy increase to 50.7 mln tonnes. From South Africa volumes increased +1.2% y-o-y to 43.2 mln t. India saw a correction of -1.3% y-o-y in Jan-Oct 2024 to 32.8 mln t. Ukraine has seen a rebound to 12.0 mln t from just 0.6 mln t in the same period of 2023. This however is still below the 20.3 mln t exported by Ukraine in Jan-Oct 2021”.

Source: Banchero Costa

“Demand has been again rebounding in China and the Middle East. Iron ore imports into China increased by +3.7% y-o-y in Jan-Oct 2024 to 1035.6 mln tonnes. Imports into Japan declined by -4.4% y-o-y to 76.5 mln t. Volumes into South Korea increased by +1.4% y-o-y to 59.9 mln t. Imports into Malaysia increased by +13.4% y-o-y to 19.5 mln tonnes. To Vietnam volumes were up by +40.4% y-o-y to 17.8 mln t. To Oman, volumes were up +18.0% y-o-y to 11.8 mln t, to Saudi Arabia by +21.8% y-o-y to 9.4 mln t, to Turkey +13.6% y-o-y to 7.5 mln t”, Banchero Costa said.

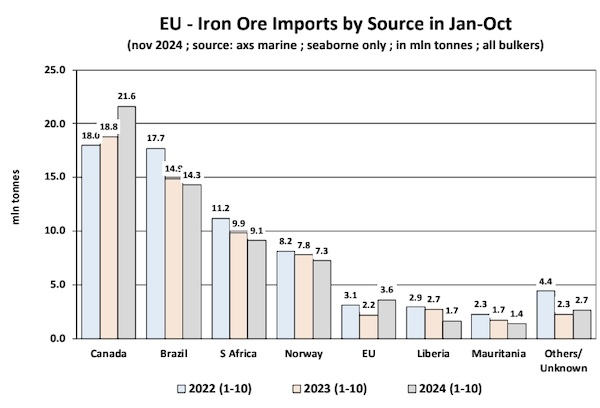

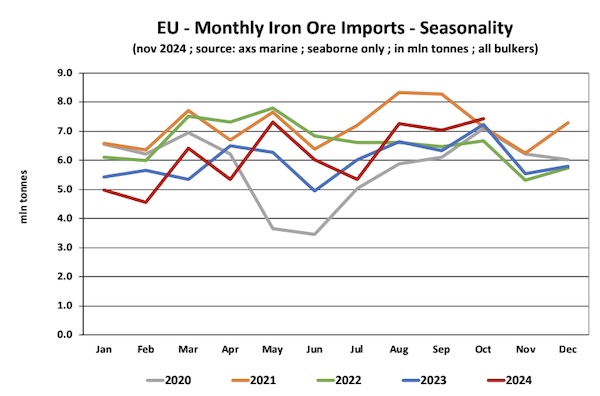

According to the shipbroker, “the European Union (27) is currently the third largest importer of iron ore in the world, after China, and Japan. Europe’s steel industry has long been overshadowed by China and the rest of Asia, and presently Europe accounts for just 7% of global crude steel production, and 5% of global iron ore imports. In the 12 months of 2023, the EU imported 71.6 mln tonnes of iron ore, which was a -9.3% decline y-oy, from 78.9 mln tonnes imported in the full year 2022. This was also well below the 87.7 mln tonnes imported in 2019 or the 98.2 mln t in 2018. In January-October 2024, imports into the EU rebounded by +2.3% yo-y to 61.7 mln t, from 60.3 mln t in the same period of 2023. About 48% of imports into the EU in Jan-Oct 2024 were loaded on Capesize or VLOC tonnage, about 39% on Panamaxes or Post-Pmx, and 9% on Supramaxes”.

Source: Banchero Costa

“In terms of individual countries, 45.7% of EU imports in Jan-Oct 2024 were done by the Netherlands (largely due to the importance of Rotterdam as a gateway port). German ports accounted for 17.7% of imports in Jan-Oct 2024, followed by France with 13.4%, Belgium with 7.0%, Spain with 5.3%, Italy with 3.7%, Slovenia with 3.2%. Looking at individual discharging ports in the EU, we have: Rotterdam (21.5 mln tonnes of iron ore discharged in Jan-Oct 2024), Hamburg (7.6 mln t), Dunkirk (6.0 mln t), Ijmuiden (5.4 mln t), Ghent (4.1 mln t), Bremen (3.2 mln t), Gijon (2.8 mln t), Fos (2.2 mln t), Taranto (2.2 mln t), Koper (2.0 mln t), Raahe (1.1 mln t), Constanta (0.7 mln t), Swinoujscie (0.2 mln t). When it comes to the sources of the shipments, Brazil has now lost its top spot to Canada. Canada was the overall top supplier of iron ore to the European Union in Jan-Oct 2024, accounting for 35.1% of the EU’s total imports last year. Shipments from Canada to the EU increased by +14.9% y-o-y in Jan-Oct 2024 to 21.6 mln tonnes, from 18.8 mln t in Jan-Oct 2023. Shipments from Brazil to the EU, on the other hand, declined in Jan-Oct 2024 by -4.0% y-o-y to 14.3 mln tonnes. Brazil accounted for 23.2% of the EU’s ore imports in Jan-Oct 2024”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide