Dry Bulk S&P Market Heats Up

Ship owners’ “appetite” for dry bulk newbuildings and second hand ships increased last week. In its latest weekly report, shipbroker Banchero Costa said that “in the container sector, Dalian Shipbuilding Industry in China secured an order for 2 x 7,165 teu carriers from the Singapore-based company Asiatic Lloyd. The price for each vessel is $40 mln and both are dual-fuel ammonia. Deliveries are set for Q3 2028 and Q1 2029. Another Singapore-based company, Eastern Pacific Shipping, placed an order of 4 x 6,000 teu carriers to Chinese yard Hengli H.I. Deliveries for all four vessels are set for Q3 2027. Chinese company OVP Shipping placed an order of 2 x 4,350 teu carriers to Chinese builder Taizhou Jianxing H.I. Deliveries for these vessels are set for mid and late-2027. Chinese yard Yangzijiang Shipbuilding secured an order of 6 x 2,900 teu carriers from India’s Interasia Shipping. Deliveries are set to start Q1 2028 and finish Q2 2030. In the gas sector, the Japanese company Lepta Shipping placed an order of 2 x 40,000 cu.m. LPG carriers to the China-based shipyard YangziMitsui. Each vessels is priced at $67 mln and can run on conventional fuel and LPG. Both are set to be delivered Q2 2026. In the chemical sector, Zhejiang Yongxin Shipping in China secured an order from Turkey’s Stella Gemi for 3 x 7,300 dwt chemical carriers. All three vessels are set to be delivered mid-2027”, the shipbroker said.

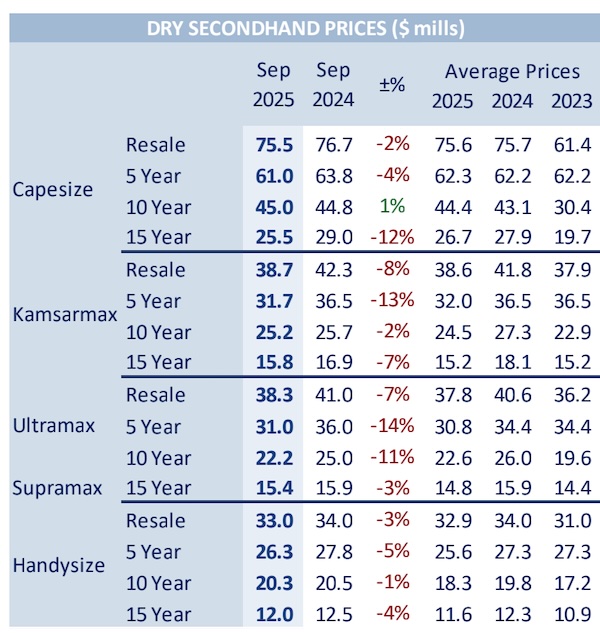

Source: Banchero Costa

In a separate report, shipbroker Xclusiv said that in the S&P market, in dry “the 36th week of 2025 was one of the busiest weeks of the year in bulker SnP activity. In the Capesize sector, Greek buyers acquired the “Frontier Neige” – 183K/2011 Kawasaki and the “Cape Jacaranda” – 181K/2011 Imabari for USD 25 mills each, both basis delivery within 2026. On the Post Panamax segment, the “NBA Rubens” – 107K/2011 Oshima was sold to Greeks for USD 15 mills. On the Kamsarmax sector, the “Kaya Oldendorff” – 82K/2024 Jiangsu New Hantong was sold for mid/high USD 34 mills, while Indian buyers committed the “Ultra Jaguar” – 82K/2016 Tsuneishi Zhoushan for excess USD 24 mills. The “Silver Navigator” – 80K/2011 STX fetched USD 15.5 mills, while Greek buyers acquired the “Eternal Bliss” – 82K/2010 Tsuneishi for mid/high USD 16 mills.

On the Ultramax sector, Greeks acquired the Scrubber fitted “Hakata Queen” – 60K/2016 Mitsui for USD 23.5 mills. Two Vietnamese-built Ultramaxes, the “Pacific Ace” – 60K/2012 Hyundai Vinashin and the “Pacific Pride” – 60K/2012 Hyundai Vinashin, were sold for high USD 13 mills each. In addition, the Supramax “Marinor” – 57K/2009 Jiangsu Hantong changed hands for USD 10.8 mills, while the “Jin Rong” – 58K/2008 Tsuneishi Cebu was sold for region USD 12 mills. On the Handysize sector, Nova Marine acquired the “Lilac Harmony” – 39K/2020 Tsuneishi Cebu for low USD 25 mills. Turkish buyers acquired the “Madrid” – 31K/2013 Tsuji Heavy and the “Mykonos” – 31K/2013 Tsuji Heavy for USD 22 mills enbloc. The “Zudar” – 38K/2011 Imabari was sold for mid USD 13 mills. Finally, Fijian Highton acquired enbloc the Ice Class 1C general cargo vessels “Pacific Hero” – 28K/2011 Huanghai and “Pacific Honour” – 28K/2011 Huanghai, each capable of carrying 1,642 TEU, for USD 32 mills”.

Source: Xclusiv

Moving on to the wet segment, “in the Suezmax sector, the “Jasmine Knutsen” – 149K/2005 Samsung was sold for USD 33 mills basis SS/DD freshly passed, while Indian buyers acquired the “Samurai” – 150K/2009 Universal for USD 39 mills. On the Aframax/LR2 sector, Navios Maritime committed on two newbuilding resales, the “Zhoushan Changhong CHB3026” – 115K/2027 Zhoushan Changhong and the “Zhoushan Changhong CHB3027” – 115K/2027 Zhoushan Changhong for USD 66.5 mills each. Finally, on the Small Tanker sector, the “Eastern Orchid” – 13K/2018 Zhejiang Shenzhou was sold at region USD 17 mills”. Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide