Dry Bulk Shipping: Policy is now as Major Catalyst for Market Direction as Seasonality

The ever-shifting tides of the shipping freight market are proving to be difficult to navigate. For example, in the dry bulk market, seasonality used to be a defining factor, but lately policy have proven to be equally as important. In its latest weekly report, shipbroker Xclusiv said that “in dry bulk shipping, seasonal cycles often play a significant role in shaping rate behavior. The period between April and May, in particular, is frequently viewed as a transition phase—sandwiched between the winter-driven energy demand and the agricultural and industrial uptick of summer. To assess whether this interval is consistently marked by weakness or stability, we analyzed the Baltic Exchange time charter (TC) averages—Capesize, Panamax, Supramax, and Handysize—across the years 2017 to 2025, comparing the April–May figures with annual trends to determine whether this period tends to align with yearly lows, highs, or averages”.

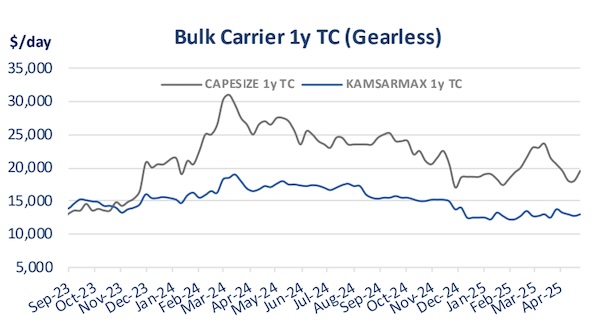

Source: Xclusiv

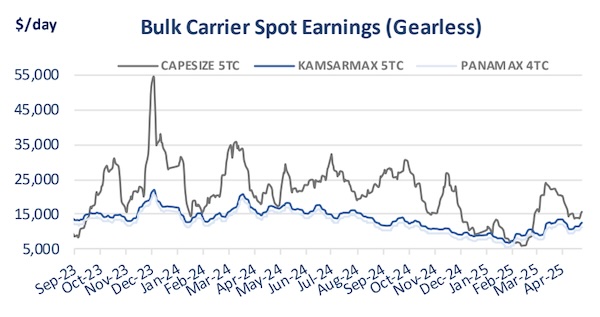

According to Xclusiv, “the Cape index, driven largely by iron ore and coal volumes, exhibited significant volatility throughout the examined period. In 2017, 2018, and 2024, April–May averages landed noticeably below the yearly mean, positioning near annual lows. This is consistent with seasonal slowdowns in Chinese iron ore imports following strong Q1 restocking campaigns. However, in 2021 and 2022, the index stayed closer to its average during spring, buoyed by factors such as port congestion and post-pandemic stimulus in China. The data suggests that while Capes can occasionally find spring support, the period more often represents a breather rather than a breakout. Pmax TCs, supported by grain, coal, and minor bulk trades, showed less volatility but still reflected a modest downturn in April–May compared to annual averages, especially in 2023, when the market faced subdued grain exports from South America and uncertain trade policy signals. In contrast, 2025 showed a partial rebound in spring rates, though still not reaching the yearly average. Overall, the Pmax segment reflects regional fragility in spring, particularly sensitive to agricultural flows and shifts in Atlantic demand. In both Supra and Handy segments, spring performance proved to be more consistent. The April–May periods in 2017, 2020, and 2022 tracked closely with the annual averages, suggesting more balanced, regionalized trade flows and less exposure to the dramatic swings seen in larger segments. The lack of deep seasonal troughs in these markets may reflect stronger resilience in coastal and intra-Asian trades, which operate on different cycles than longer-haul Cape or Pmax voyages”.

The shipbroker added that “the data from 2017 to 2025 suggests that April and May are rarely the defining low points of the year, but they do often represent a moment of pause in the market’s momentum. Particularly for larger vessels, the season is prone to dips rather than sustained rallies, but generalizations must be treated cautiously. What is increasingly clear, however, is that seasonality alone no longer dictates market direction. External influences—especially political decisions—are becoming critical in shaping short-term trends. For instance, President Trump’s recent tariff policies and renewed trade pressure on China and key industrial goods could distort cargo flows, particularly for coal, steel, and grain—cornerstones of dry bulk demand. Tariffs on Chinese-built ships or industrial products may indirectly dampen vessel orders, delay project cargoes, or shift key trade lanes”.

Source: Xclusiv

“These evolving dynamics underscore that even traditionally predictable periods like spring are now influenced as much by policy as by season. For market participants, this means that close monitoring of political developments is just as crucial as reading seasonal demand curves—particularly in a time when trade wars can reshape shipping’s supply-demand equilibrium virtually overnight”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide