Dry Bulk Shipping Demand to Increase, While Lower Fuel Oil Prices Can Further Boost Shipping

The shipping market stands to benefit from falling oil prices, as fuel oil costs will diminish as well, while the dry bulk segment in particular could enjoy further tailwinds. In its latest weekly report, shipbroker Xclusiv said that “Asia’s seaborne imports of metallurgical coal fell to their lowest level in three years in February, signaling a decline in freight demand for bulk carriers. The primary reasons behind this slump are lower steel production in China and India combined with government interventions in raw material imports. India’s government-imposed quotas on coke imports and increasing steel imports from South Korea and China have reduced domestic steel output, leading to a drop in coking coal demand. Although these restrictions may be temporary they have already curtailed the demand for bulk carriers transporting coking coal, affecting freight rates in the region. Similarly, China’s metallurgical coal imports fell to an 18-month low, with overland imports from Mongolia increasing and reducing reliance on seaborne shipments”.

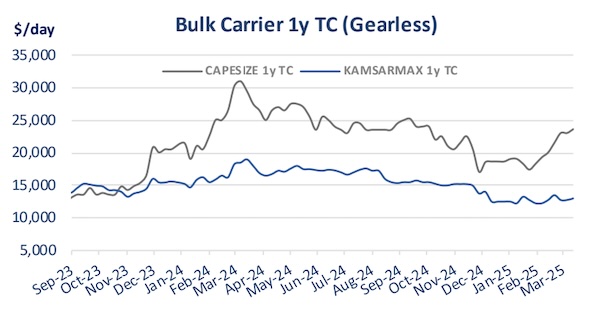

Source: Xclusiv

Meanwhile, “adding further complexity, China imposed a 15% tariff on U.S. coking coal imports, effectively ending its reliance on American supply. As China shifts to alternative suppliers like Australia and Canada, trade flow adjustments are likely to increase demand for certain shipping routes while reducing activity on U.S.-China coal trade routes. The recent U.S. 25% tariffs on steel and aluminum imports have led the UAE’s aluminum exports to the U.S. surging in early March before the tariffs took effect, shipping volumes spiked temporarily, but a long-term slowdown in aluminum shipments is expected as tariffs dampen demand. Canada, the largest supplier of steel and aluminum to the U.S., has retaliated with 25% tariffs on U.S. metals and other goods”, Xclusiv said.

According to the shipbroker, “the International Energy Agency (IEA) has warned that new U.S. tariffs could weaken global oil demand in 2025, adding to the uncertainty in the shipping industry. Global oil supply is expected to exceed demand by 600,000 barrels per day, leading to lower crude oil shipments and potential freight rate declines. Additionally, high-profile U.S. tariffs on China, Canada, and Mexico could contribute to a macroeconomic slowdown, reducing industrial activity and thereby limiting demand for oil transport. Conversely, OPEC+ plans to unwind voluntary production cuts, which could increase crude shipments, but compliance remains uncertain. Kazakhstan’s ramp-up of its Tengiz oil field production has boosted global oil supply, yet Venezuela’s production forecast has been cut due to Chevron’s license loss, which could tighten availability and affect shipping routes from South America”.

Source: Xclusiv

“Despite oil price volatility, lower oil prices could benefit the shipping industry by reducing fuel costs for vessels. However, this potential advantage may be offset by lower transport demand, meaning freight companies must balance cost efficiency with volume reductions in the coming months. The convergence of these trade disruptions and economic pressures presents both challenges and opportunities for the shipping industry. Bulk carriers transporting metallurgical coal are likely to see demand fluctuations, with Indian and Chinese policies determining whether imports recover. Container shipping may experience uncertainty as U.S. tariffs force companies to reconfigure supply chains, impacting port congestion, transit times, and trade volume. Oil tanker freight rates may face downward pressure, unless OPEC+ production policies lead to higher shipping demand. Alternative trade routes may develop, creating opportunities for carriers in emerging markets as companies shift sourcing strategies”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide