Dry Bulk Market: Slower Demand to Hurt Freight Rates Throughout 2025

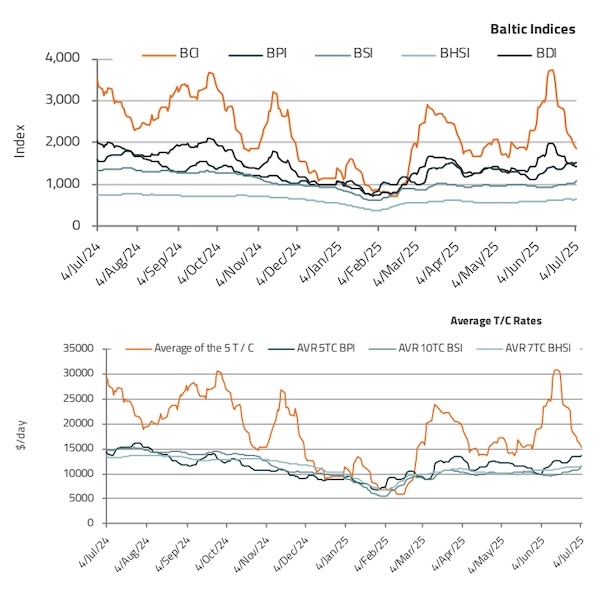

Dry bulk demand is expected to remain soft throughout 2025, with a few exceptions. In its latest weekly report, shipbroker Intermodal said that “the Baltic Dry Index is on a downward trend, suffering losses of 28% since mid-June, reading 1,431 at the time of writing. This drop is primarily driven by softening market conditions in the Capesize segment, with the Baltic Capesize Index plunging more than 50% from its June peak of 3,731 to 1,825. This decline reflects softening demand for the two core commodities of the Capesize sector, iron ore and coal, both influenced by China’s declining imports”.

According to Intermodal’s Senior Analyst, Mr. Nikos Tagoulis, “iron ore drives Capesize trade, accounting for over 70% of the segment’s cargo volumes and tonne-mile demand. As a result, Capesize tonnage demand closely tracks iron ore flows, particularly from China which accounts for more than three-quarters of global imports. Consequently, any slowdown in Chinese demand tends to ripple quickly through the market. The iron ore demand has weakened amid a downturn in China’s steel industry, impacted by slowing construction activity, a sluggish real estate sector, seasonal factors, and anti-dumping trade actions by other countries, dampening Chinese steel exports. As a result, Chinese iron ore imports are projected to decline by 3% in full 2025, while global imports are expected to contract by 2%”.

Source: Intermodal

Meanwhile, “coal trade faces similar conditions. Global seaborne coal trade is projected to decline by 6% in 2025, with Chinese imports dropping by 11%. This decline is largely driven by rising domestic coal output in China, elevated inventories, increased coal transportation via rail from Mongolia, and a growing trend for energy production from renewable sources”.

“Amid this challenging landscape, the bauxite trade provides a source of optimism. Global bauxite seaborne volumes are estimated to grow by 19% y-o-y in 2025, propelled by increased exports from Guinea to China, reflecting the latter’s strong demand for aluminium, driven by the expansion of its electric vehicle and renewable energy sectors. Despite being a major bauxite producer itself, China is also top bauxite importer, expected to import approximately 194m tons in 2025, up 22% y-o-y and representing 87% of global bauxite imports. Additionally, the longer haul Guinea–China route is adding more to the ton-mile demand compared to the shorter route Australia-China. Despite the possibility of some weather-related logistical disruptions in Guinean ports during West Africa’s monsoon season ranging from May to October, overall, the bauxite trade is expected to offer substantial support to Capesize segment within 2025”, Mr. Tagoulis said.

He added that “on the supply side, the Capesize fleet currently consists of 2,046 vessels with a combined capacity of around 404 m dwt, representing a y-o-y growth of 1.3%. The fleet’s average age has increased to 11.67 years, up from 10.86 years in 2024, continuing a gradual aging trend since 2017. The orderbook comprises 165 vessels totalling 36.2m dwt, equivalent to ca. 9% of the fleet, marking the highest level since 2021, though still well below the 15-year average of 22.6%. Demolition activity remains limited, with 3 Capesize vessels of ca 0.61m dwt recycled so far in 2025. Following 2020 surge of demolition volumes, amid the pandemic linked slowdown of global trade, with 49 vessels of ca. 11.4m dwt sent to the shipbreaking yards, demolition activity is deteriorating in the last years, with demolition volumes declined to 5 vessels of ca. 0.85m dwt in full 2024. In terms of dwt, demolition to deliveries ratio is increased comparing to 2024, standing at 15% to date 2025, versus 11% of 2024 and 9.6% in 2023. The current market environment is clearly reflected in freight rates. At the time of writing, Capesize 5TC spot earnings have fallen to $14,521 per day, more than a 50% decline from the mid-June peak of nearly $31,000 per day and 40% below the June average”.

Source: Intermodal

“Looking ahead, the Capesize market remains fragile. A recovery will depend on a rebound in China’s industrial production and steel output. While the bauxite trade is gaining traction and offers support, the broader outlook is softened. Finally, a key factor to monitor is the development of USA trade policy decisions, as the temporary pause on increased tariffs expires tomorrow and US President Trump increases pressure to US trading partners by announcing new tariff rates, effective from August 1st, while leaving at the same time room for further negotiations. A potential increase of tariffs in several commodities, including steel and aluminum, could cause new challenges to the dry bulk seaborne demand, impacting cargo flows”, Intermodal’s analyst concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide