Dry Bulk Market: Each Ship Class is Telling a Different Story

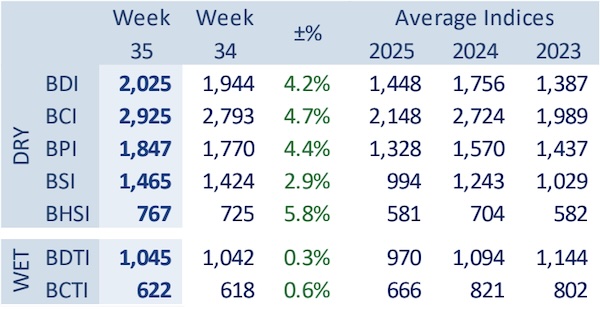

Depending on the ship type, the dry bulk shipping market tells a very different story so far this year. In its latest weekly report, shipbroker Xclusiv said that “now that summer has come to an end, it is a good moment to look back and assess how the dry bulk market evolved through the season, comparing the performance of summer 2025 with the previous two summers. Seasonal patterns are often a reliable barometer of underlying demand, with June to August setting the tone for the final quarter of the year. From 2023 onwards, the market has told three very different stories, with Capesizes showing volatility, Panamaxes too, while geared segments displayed resilience & stability”.

Source: Xclusiv

According to Xclusiv, “in the Capesize market, the summer of 2023 stood out for its strength. The season began with C5TC near USD 9,700/day in early June, reflecting weak iron ore flows. Yet as the summer advanced, Chinese restocking and firmer Atlantic activity triggered a sharp recovery. By late August, Capesizes were earning around USD 21,300/day, more than double the opening level and right at the seasonal high. The following year, 2024, painted a different picture. C5TC opened June at USD 23,300/day and climbed into the low USD 32,000s by July, giving the impression of another robust season. However, momentum quickly faded, and by the end of August rates had slipped back to USD 23,900/day, almost identical to the opening level. This year, 2025, the pattern has been similar. Starting June at USD 19,000/day, Capes peaked near USD 31,700/day in late July, only to retreat below USD 24,000/day at the end of August. For a third consecutive summer, the largest vessels failed to consolidate gains, leaving the season defined by volatility”.

Meanwhile, “Panamaxes, by contrast, have been steadier. In 2023, the P5TC began June just above USD 9,200/day and closed August at USD 13,500/day, close to its high. In 2024, P5TC opened at USD 15,100/day, briefly touched USD 17,600/day in mid-June, but ended the summer almost flat at USD 15,600/day. This year, however, the picture has been more positive. Panamaxes started June 2025 at USD 10,000/day and climbed throughout the season to finish August at nearly USD 16,800/day, closing on their highs and offering owners a constructive run. Supramaxes and Handysizes have shown even greater resilience. In 2023 S11TC moved from USD 11,100/day in June to USD 13,600/day in August, while in 2024 they strengthened from USD 12,000/day to USD 16,600/day, closing at the top. The summer of 2025 extended this trend: from USD 12,000/day in early June, Supras rose steadily to USD 18,400/day at the end of August, the strongest close of the summer period. Handys followed the same path. From USD 10,800/day in June 2023 they ended that summer at USD 12,800/day, while in 2024 they climbed from USD 12,000/day to USD 13,500/day. This year, HS7TC from USD 10,779/day on early June, advanced to USD 13,600/day by late August, again finishing on the seasonal peak”, Xclusiv noted.

Source: Xclusiv

The shipbroker added that “the conclusion of this year’s summer cannot be separated from developments in China’s coal market. Domestic output surged 5.4% year on year in the first half of 2025, curbing demand for imports. But when heavy rains and a government crackdown hit mining in July, production fell 3.8% year on year to its lowest since April 2024. This disruption reopened the arbitrage for seaborne cargoes, reviving Chinese demand just as geared vessel earnings were firming. Imports totalled 139.7m tons in H1 2025, down from 174.6m tons a year earlier, but enquiries rose in late summer as domestic supply faltered. The impact was clear: while Capes struggled to hold their gains, Panamaxes, Supramaxes and Handys ended August on their highs. Summer 2025 confirmed once again that in an uncertain Capesize environment, shifting Chinese coal fundamentals can still underpin strength for the geared fleet, cementing their role as the backbone of stability in the dry bulk market”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide