Dry Bulk Carriers In Demand

Dry bulk carriers have been in high demand over the past few weeks, both in terms of newbuildings and second hand sales. In its latest weekly report, shipbroker Banchero Costa said that in the newbuilding market “in the dry sector, Chinese company Shandong Shipping placed an order of 10 x 325,000 dwt ore carriers (Guaibamax design) to Chinese yard Qingdao Beihai. All vessels will be scrubber fitted and will have a dual fuel methanol propulsion. No price was disclosed and deliveries are set to start in mid-2026 and finish in mid-2031. The Chinese yard Jiangsu New Hantong secured an order of 4 x 82,000 kamsarmax vessels from the Egyptian state-owned National Navigation Company. No price was disclosed and deliveries are set for late 2028. In the tanker sector, Capital Maritime exercised an option for one 320,000 dwt VLCC to South Korean shipyard Hanwha Ocean takin the total order now to 3 vessels. The price is $125 mln. and delivery is set for June 2028. Evalend Shipping Co. ordered 2 x 157,000 dwt suezmaxes to South Korean Huyndai Samho. Both vessels will use conventional fuel and will be scrubber fitted. The price for each vessel is $90 mln. and deliveries are set for Sept 2027 and June 2028. In the LNG sector, Capital maritime placed an order for 4 x 174,000 cu.m. LNG carriers to Hyundai Samho. No price was disclosed and deliveries are set to start in Q4 2026 and finish in Q1 2028”.

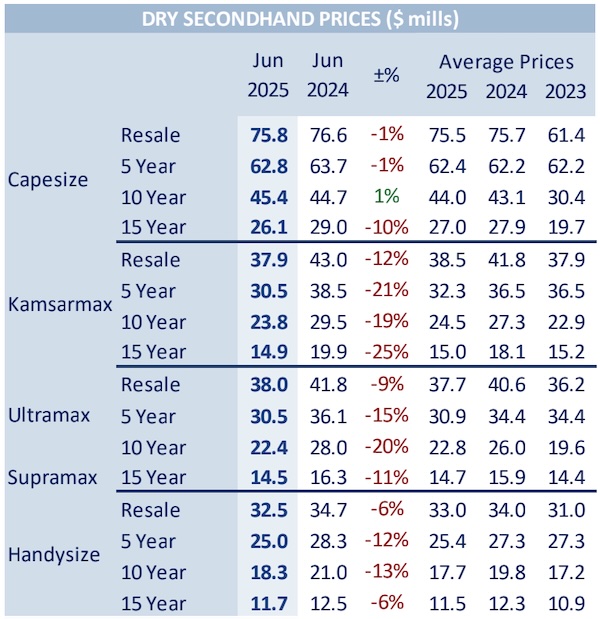

Source: Banchero Costa

Meanwhile, in the S&P market, shipbroker Xclusiv noted that it’s been “a busy week in the dry bulk S&P market, with transactions spanning all segments from Capesize to Handysize. In the Capesize segment, the two scrubber-fitted Chinese-built Capes, the “Pacific East” – 176K/2012 SWS and the “Golden Zhoushan” – 176K/2011 Jinhai Heavy, were sold for USD 27.5 mills and USD 22 mills, respectively. Moving to the Kamsarmax/Panamax segment, Greek buyers acquired the “Atalanta” – 82K/2010 Tsuneishi Zhoushan for USD 15.5 mills, while the “SDTR Dora” – 82K/2019 Jiangsu Jinling was reported sold for USD 24.5 mills via auction. The vintage Japanese-built “Chola Virtue” – 77K/2003 Imabari achieved a price in the low/mid USD 6 mills. In the Ultramax/Supramax segment, the “IVS Swinley Forest” – 60K/2017 Sanoyas was sold to Greek buyers for USD 23.5 mills, while the Chinese-built “Sagar Shakti” – 58K/2012 Tsuneishi Zhoushan reportedly achieved a price in the high 13s mills. The woodchip carrier Supramax “Luminous Sky” – 54K/2005 Sanoyas was committed to Chinese buyers for USD 6.25 mills. The “Castlegate” – 53K/2008 Iwagi was sold for USD 11 mills with DD due imminently, while the vintage “Ocean Princess” – 52K/2002 Tsuneishi changed hands for USD 7.38 mills. The Handysize market saw significant action as well. Italian buyers acquired the resale “Jiangsu Dajin DJHC6118” – 40K/2025 Jiangsu Dajin for USD 30 mills. European buyers committed enbloc to the “Four Rigoletto” – 34K/2011 SPP, “Four Butterfly” – 34K/2011 SPP, and “Four Turandot” – 34K/2012 SPP for region USD 39 mills total. Additional activity included the “Yuka D” – 34K/2011 Zhejiang Jingang sold for USD 9 mills and the “Strategic Endeavor” – 33K/2010 Zhejiang Zhenghe for USD 7.5 mills with surveys due”.

A similarly strong activity was also evident in the wet segment. Xclusiv said that “this week saw strong activity in the tanker S&P market, with 12 reported sales across all major sectors, from VLCCs to small chemical tankers. In the VLCC sector, the “New Tinos” – 300K/2003 Universal was sold for USD 37 mills. Within the Suezmax segment, the “Concord” – 159K/2005 Hyundai Heavy was committed to Chinese buyers for USD 23.5 mills, while in the Aframax/LR2 segment, the “Montreal Spirit” – 150K/2006 Universal fetched USD 30 mills from Greek interests. On the Panamax/LR1 front, the sister vessels “PGC Companion” – 73K/2005 and “PGC Marina” – 73K/2005, both built at Hudong Zhonghua, were sold enbloc for USD 10 mills each. The MR2 sector remained active with several sales. The “PS Vancouver” – 51K/2007 STX was sold for USD 13 mills basis delivery in 3-4 months, Ice Class 1A/DPP. Greek buyers acquired the “PTI Huang He” – 50K/2016 SP for USD 32 mills. The “Pacific Quartz” – 48K/2011 Iwagi Zosen fetched USD 18.2 mills, and the “Grand Ace7” – 46K/2007 STX was sold to UAE-based buyers for USD 15 mills. Indian interests took the IMO 3 “Prelude” – 40K/2007 Saiki Heavy for USD 14 mills. From the smaller sizes, the stainless steel “Sinar Minahasa” – 13K/2007 Higaki was sold for USD 13.5 mills basis DD due. Lastly, the bunkering tanker “Santa Rita” – 2.5K/2008 San Giorgio changed hands for USD 4 mills”.

Source: Xclusiv

Similarly, Banchero Costa said that “in the Bulk sector undiscolsed buyers were behind the purchase of the Capesize PACIFIC EAST 176,000 dwt 2012 Shanghai Waigaoqiao Built sold at $27,5 mln. In the Kamsarmax segment SANTA GRACIELA 82,000 2013 dwt Tsuneishi built was sold to Greeks at range $18,5 mln. For comparison similar vessel BRIGHT PEGASUS 82,000 dwt 2013 Tsuneishi built was sold beginning of June at $17,5 mln. In the Panamax segment CHOLA VIRTUE 77,000 dwt 2003 Imabari built wassold at low $6 mln. In the Ultramax segment HAKATA QUEEN 60,000 dwt 2016 Mitsui built was sold to undiscolsed buyers at $23 mln for comparison NORD MISSISSIPPI 60,000 dwt 2015 Mitsui built was sold at range $22 mln last month. In the Handysize segment ARIES SAKURA 39,000 dwt 2020 ShinKurushima built was sold to Greeks at $25 mln. For comparison BUNUN ORCHID 37,000 dwt 2021 I-S built was sold in May at $25 mln. In the Container sector ESCAPE and ESPOIR both 1436 teu 2011 each Sainty built were sold enbloc basis $40 mln. SEABOARD RANGER and SEABOARD OCEAN both 1114 teu both 2009 built Yangzhou built were sold to MSC at $18 mln each. In the Crude Oil sector Turkish buyers were behind the purchase of the VLCC C.SPIRIT 313,000 dwt 2013 Hyundai built sold at $67,50 mln. For comparison in March DHT LOTUS 320,000 dwt Bohai China built was sold at $55,0 mln. NEW TINOS 300,000 2003 Universal built was sold to undisclosed buyers at $37,0 mln”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide