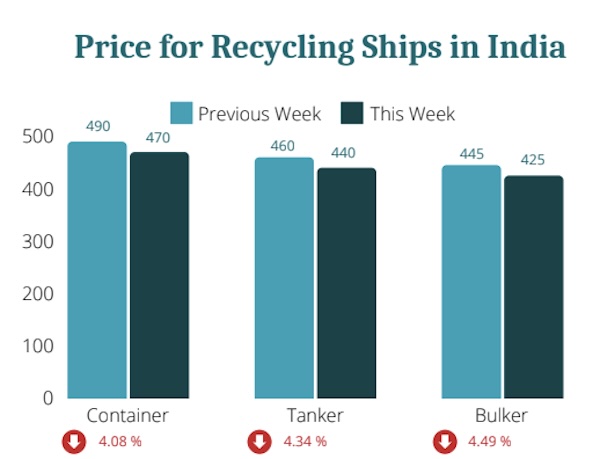

Downward Price Momentum in the Ship Demolition Market

The ship breaking market has been trending downwards over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “this week in the ship recycling market saw consistent challenges across regions, with demand largely stalled and activity slow. In India, the market continues to struggle under prolonged low demand and stagnant trends. With Diwali just around the corner, expectations remain muted, and any hopes for recovery are now set for November, relying heavily on broader market shifts that feel uncertain at best”.

Source: Best Oasis

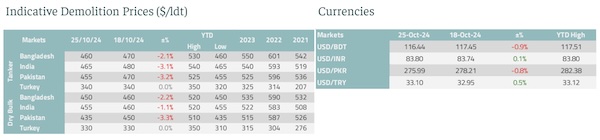

“In Bangladesh, buyer interest remains but is slowed by issues such as banking restrictions, local regulations, and pending environmental policies. The recent government change has added an adjustment period, creating an uncertain environment for transactions. Pakistan’s market showed a brief spark of activity but quickly settled back down as limited local support slowed momentum and ongoing deals. Türkiye ended the week much like the last, with market conditions holding steady and little to report in the way of change. Altogether, this week highlights an industry waiting for movement yet faced with familiar obstacles across the board. Global growth faces growing uncertainties as geopolitical and economic risks deepen, with rising Middle East tensions, strained US-China relations, and an increasingly volatile trade environment, noted by the World Bank and IMF at their annual meetings. Leaders emphasized the urgent need for global cooperation to support vulnerable economies and tackle rising protectionism, which could further destabilize international trade. The IMF cautioned that without decisive actions from major economies to address issues like China’s weakening real estate sector and soaring global debt—projected to surpass 100 trillion USD by year-end—the world may encounter deeper financial instability, potentially stalling recovery and impacting economic stability worldwide”, Best Oasis said.

In a separate report, shipbroker Intermodal added that “last week saw continued downward pressure on demolition prices in key recycling regions, driven by sluggish steel demand, limited liquidity and a challenging economic backdrop. The Indian market saw another week of lower prices, driven by cautious buyer sentiment ahead of Diwali and continued liquidity constraints. The central bank’s strict anti-inflation measures mean that liquidity remains tight, dampening the willingness of recyclers to offer higher bids. Any near-term recovery in prices will depend on a post-holiday pickup in demand, which remains uncertain given these economic headwinds. In addition, the RBI is not expected to cut interest rates until Q1 2025, leaving them at 6.5%. On the macro side, India is expected to grow by 7% in the current fiscal year, which runs from April to March”.

Source: Intermodal

“In Bangladesh, a recent change in government has introduced new regulatory complexities which, combined with ongoing liquidity issues, have deterred buyer interest. The central bank’s interest rate hike, now at 10%, is putting further pressure on the market, where limited access to credit and defaults are weighing heavily on operations. With demand constrained, recyclers remain selective in their tonnage, mostly for larger vessels and only at opportunistic pricing levels where possible. The Pakistani market remains lethargic with recycling buyers showing little appetite as steel demand continues to stagnate and the local currency depreciates. Ongoing loan restructuring discussions with China provide a glimmer of economic support but are unlikely to spur immediate market activity. Domestic fundamentals remain weak, with Pakistan largely following India’s lead in terms of price movements, with stable but subdued prices. In addition, the country has requested an additional $1bn Resilience and Sustainability Trust from the IMF, on top of the $7bn already requested”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide