Container Ships Dominating Newbuilding Orders

Container ships have been the “darlings” of the newbuilding market. In its latest weekly report, shipbroker Banchero Costa said that “the newbuilding market is still dominated by containerships orders. There is a massive action taken by the main players in the container field to book slots and renew or expand their trading fleet. More than 50 orders have been placed in different segments from feeder to larger ships. MSC, besides being the largest owner of container, it’s contributing with more than 25 NBs orders (still to be identified) and other major players like Maersk and Hapag Lloyd are said to be looking at placing similar number and more. This week it was Maersk who took the stage. the Danish giant is rumoured have signed a contract with the Korean yard Hanwha Ocean for the construction of 6 + 4 16,000 teu. The price reported for each vessel was around $220 mln, while deliveries for the firm ships are expected in 2027. Maersk was also rumoured having booked other 16,000 teu at Chinese yards: letters of intent were signed at New Times for 6 + 6 units, for delivery in 2028, and Yangzijiang for 6 + 4 units, for delivery in 2027. The Danish Owner was rumoured in the market for up to a total of 62 vessels among Korean and Chinese yards. All the vessels will be dual fuel LNG propelled. Pacific International Lines signed an order for 5 x 13,000 teu DF LNG at Hudong Zhonghua for deliveries from the end of 2026 through 2027. Price per ship was reported in the region of $190 mln”.

Source: Banchero Costa

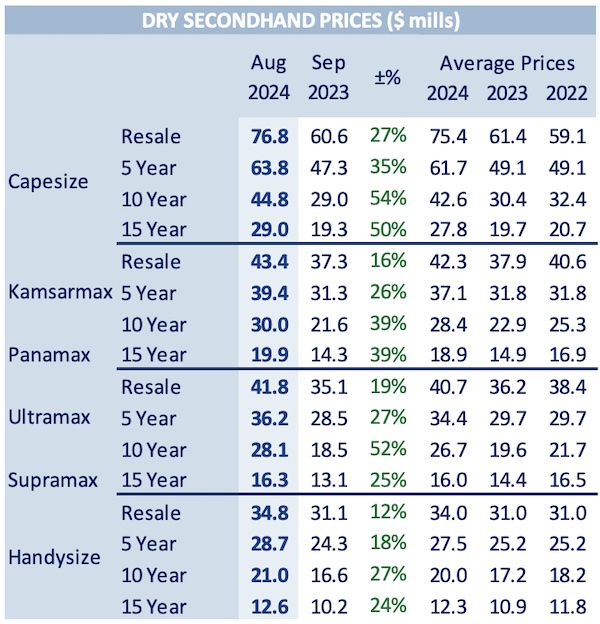

Meanwhile, in the S&P market, Banchero Costa added that “in the dry market the Japanese controlled Cape Azalea 206,000 dwt 2012 built NACKS was sold at region $39 mln to Chinese buyers. After offers were invited last week the scrubber fitted Elsa S 81,000 dwt built 2015 JMU was committed in excess of $30 mln. The Dolphin57 Sania 57,000 dwt 2010 built Qingshan was reported at $12.3 mln to Chinese Buyers waiving inspection, a few weeks ago the Seacon Yantai 57,000 dwt 2010 built COSCO was done at $13.8 mln. In the tanker market 9 scrubber fitted VLCCs changed hands from Capital to Bahri for around $1 bln. The majority of the nine unnamed vessels were built in S Korea and average 5.9 years of age”, the shipbroker concluded.

In a separate report, shipbroker Xclusiv added that in the dry market, “as the summer came to an end, the bulker secondhand market has been busy. One newcastlemax and two capesizes changed hands this week. “Cape Azalea” – 208K/2012 Nacks was sold to Greeks for USD 38.25 mills and “Azure Ocean” – 180k/2007 Imabari and “Lila Lisbon” – 176K/2003 Universal were sold to Chinese buyers for USD 25 mills and USD 12.5 mills respectively. The Indian built panamax “Golden Ruby” – 74K/2014 Papavav was sold for USD 21 mills. The supramax “Jag Rani” – 57K/2011 Cosco Zhoushan changed hands for USD 14 mills, while the handy “African Egret” – 34K/2016 Namura was sold for USD 21.75 mills”.

Source: Xclusiv

In the wet market, “once again the tanker S&P activity was strong, with one transaction more than the bulker S&P market. The LR1 “Fair World” – 75K/2004 Hyundai Heavy was sold to Chinese for USD 20.5 mills while the ice classed 1A LR1 “Two Million Ways” – 74K/2008 Onomichi, changed hands for USD 30 mills. Chinese also bought the LR1 “HTM Conqueror” – 71K/2004 STX for USD 18.75 mills. The MR2s “STI Opera” – 50K/2014 Hyundai Mipo and “STI San Antonio” – 50K/2014 SPP were sold for USD 41 mills each to undisclosed buyers, while the deepwell and zinc coated MR2 “Kalamos” – 47K/2004 Iwagi changed hands for USD 17.8 mills. Finally, the stainless steel MR1 “Lyderhorn” – 34K/2006 Shin Kurushima changed hands for USD 26.6 mills”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide