China Dominates Maritime Markets In ’24

In what should be a surprise to no one, the Chinese maritime industry continued its dominance in 2024, with the nation’s vessel orderbook surpassing $123 billion. Data from VesselsValue reveals a strong year for both Chinese shipowners and shipbuilders, with significant investments across various vessel sectors.

- Chinese Ship Owning Market

Among Chinese shipowners, China Merchants Shipping led the way with orders for 28 new vessels, worth an estimated $4.4 billion. This investment was primarily directed toward the Tanker and LNG sectors, each accounting for approximately 33% of the total orders, with additional investments in Bulk Carriers and Vehicle Carriers.

Trailing closely behind, COSCO Shipping Lines secured second place with an investment of $3.06 billion in 18 New Panamax Container vessels, ranging between 13,400 and 14,000 TEU.

COSCO Shipping Development ranked third, placing orders for 20 Bulk Carriers, including Ultramax and Kamsarmax vessels, at a total valuation of $929 million. COSCO Shipping Bulk followed in fourth, investing $822 million in 10 new ships, comprising eight Newcastlemax and two ore carriers, set for delivery between 2026 and 2028. China Shipbuilding Trading ranked fifth with an order of 22 Panamax newbuildings of 80,000 DWT, valued at $778 million. These vessels are being constructed at Chengxi Shipbuilding and are scheduled for delivery between 2027 and 2028.

Seacon Shipping Group also made a significant impact, ranking second in terms of the number of vessels ordered, with 26 new orders primarily in the Tanker sector, totaling $738 million.

Source: VesselsValue

Source: VesselsValue

- Chinese Shipbuilding Market

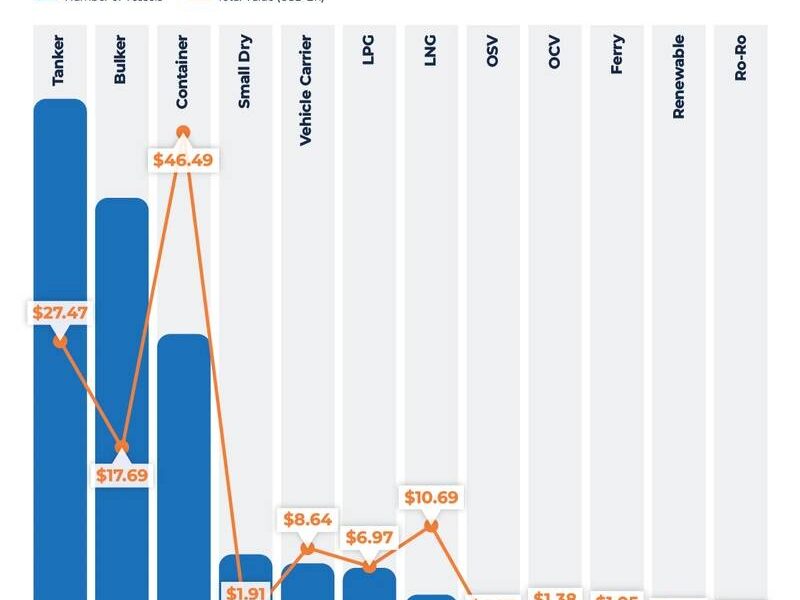

Tankers emerged as the most in-demand vessel type at Chinese shipyards in 2024, with 526 new units ordered, collectively valued at $27.4 billion. Elevated steel prices, limited yard availability, and strong demand pushed tanker newbuilding prices to their highest levels since 2009. Market disruptions, including the Red Sea crisis, further drove sentiment, leading shipowners to place substantial orders across the tanker, bulker, and container sectors. Bulk carriers ranked second, with 430 new orders worth $17.7 billion. The container sector secured third place in terms of vessel numbers, with 298 new vessel orders. However, the financial value of container orders significantly outpaced all other sectors, amounting to an impressive $46 billion. The sharp rise in container vessel valuations in 2024 made them attractive investments, despite the extended delivery timelines.

Container newbuilding prices exhibited notable increases across all sub-sectors. Post Panamax newbuildings of 7,000 TEU, for example, rose in value by over 14%, from $102 million to $116.73 million, underscoring the sector’s strong growth throughout the year.

Source: VesselsValue