Australian Coal Exports Down in 2025

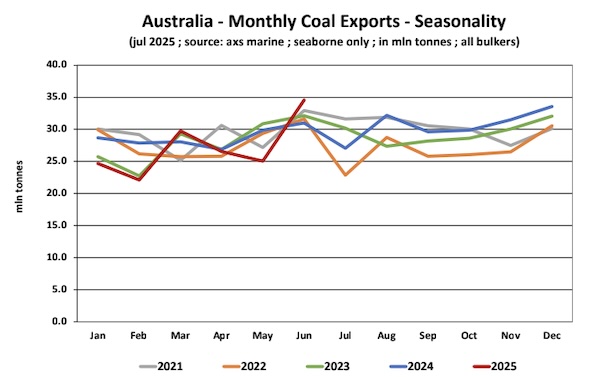

Coal exports from Australia, the second largest seaborne exporter have been down so far. In its latest weekly report, shipbroker Banchero Costa said that “in Jan-Jun 2025, global seaborne coal loadings declined by -7.9% y-o-y to 619.2 mln t (excluding cabotage), based on vessel tracking data from AXS Marine. In Jan-Jun 2025, exports from Indonesia declined by -14.1% y-o-y to 220.1 mln tonnes, whilst from Australia were down by -5.6% y-o-y to 162.7 mln t. From Russia exports declined by -1.0% y-o-y to 81.6 mln t in Jan-Jun 2025, from the USA declined by -6.9% y-o-y to 40.6 mln t, from South Africa by +5.5% y-o-y to 31.9 mln t. Shipments from Colombia declined by -28.2% y-o-y to 22.1 mln t in JanJun 2025, from Canada up by +1.2% y-o-y to 24.9 mln t, and from Mozambique down by -8.4% t-o-y to 9.6 mln t. Seaborne coal imports into Mainland China declined by -14.4% y-o-y to 167.3 mln t in Jan-Jun 2025. Imports to India declined by -2.7% yo-y to 122.9 mln t, to Japan declined by -4.0% y-o-y to 70.7 mln t in JanJun 2025, to South Korea down by -13.6% y-o-y to 46.9 mln t. To the EU imports were down by -1.9% y-o-y to 29.7 mln tonnes in Jan-Jun 2025, whilst to Vietnam volumes increased by +16.8% y-o-y to 34.9 mln tonnes. Imports to Malaysia increased by +5.8% y-o-y to 20.2 mln t, and to Bangladesh by +48.4% y-o-y to 7.7 mln t”.

Source: Banchero Costa

According to Banchero Costa, “Australia is the second largest exporter of coal worldwide, with 26.0% of global seaborne coal exports in Jan-Dec 2024, quite far behind Indonesia which had a 38.8% share in Jan-Dec 2024. Coal shipments from Australia were drastically affected in 2021-2022 by the country being backlisted by Mainland China, previously Australia’s largest customer. That said, Australian exporters were relatively successful in finding new markets limiting the impact on overall volumes, and the Chinese ban was effectively reversed from the beginning of 2023. In 2022, Australian coal exports fell sharply by -7.8% y-o-y to 329.1 mln t, from 356.9 mln tonnes in 2021, based on AXS Marine data. In 2023, volumes rebounded to 344.1 mln t, or +4.6% y-o-y. In 2024, shipments increased further by +3.5% y-o-y to 356.1 mln tonnes”.

The shipbroker added that “the main coal export terminals in Australia are Newcastle (66.0 mln tonnes loaded in Jan-Jun 2025), Gladstone (30.1 mln t), Dalrymple Bay (26.6 mln t), Hay Point (17.6 mln t), Abbot Point (15.3 mln t), Port Kembla (3.2 mln t), Brisbane (2.8 mln t), Port Hedland (05 mln t). The majority (64.7%) of coal volumes shipped from Australia in Jan-Jun 2025 were loaded on Panamax or Post-Panamax tonnage, with 32.5% of volumes shipped on Capesize vessels, and 2.4% on Handy or Supra tonnage”.

Source: Banchero Costa

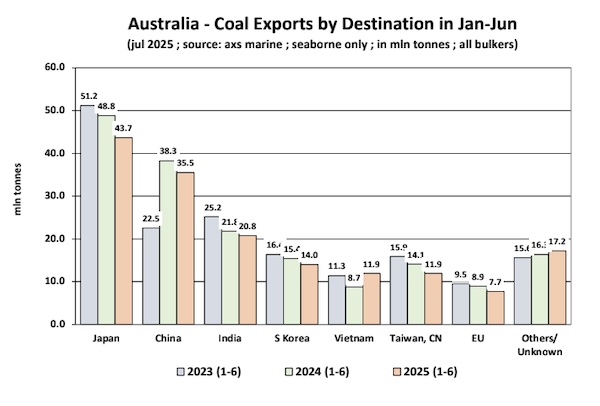

“There have been quite remarkable reshuffles in terms of trade patterns over the last few years, driven by political considerations. Coal exports from Australia to Mainland China surged by +51.4% yo-y in Jan-Dec 2024, to 84.8 mln tonnes, from 56.0 mln t in 2023. Let’s remember that in 2022, due to the “unofficial” Chinese ban, Australia shipped just 0.3 mln tonnes of coal to China. In Jan-Jun 2025, Australia exported 35.5 mln tonnes to China, down -7.1% y-o-y from Jan-Jun 2024. Mainland China now again accounts for 21.8% of Australia’s coal exports. The top destination however is still Japan, with 105.3 mln tonnes in JanDec 2024, up +2.3% y-o-y, In Jan-Jun 2025 Australia exported 43.7 mln tonnes to Japan, down -10.5% y-o-y, with Japan now accounting for 26.8% of Australian coal exports. In third place, with 12.8%, is India. In 2024, Australia exported 40.3 mln t of coal to India, down -18.5% y-o-y, from 49.4 mln in 2023. In Jan-Jun 2025, Australia shipped 20.8 mln t of coal to India, down -4.8% y-o-y. To Vietnam, volumes declined by 36.5% y-o-y to 11.9 mln t”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide