Containers

February 15, 2026

Maersk, Eurogate Plan €1B Bremerhaven Terminal Expansion | Mariner News

Shipping giants Maersk, through its APM Terminals division, and Eurogate are planning a substantial €1…

Containers

February 15, 2026

Maersk, Eurogate Plan €1B Bremerhaven Terminal Expansion | Mariner News

Shipping giants Maersk, through its APM Terminals division, and Eurogate are planning a substantial €1…

Bulkers

February 15, 2026

Panama Canal & USGBC Boost Global Grain Trade | Mariner News

The Panama Canal and the U.S. Grains & BioProducts Council (USGBC) recently formalized a crucial…

Bulkers

February 15, 2026

Panama Canal & USGBC Boost Global Grain Trade | Mariner News

The Panama Canal and the U.S. Grains & BioProducts Council (USGBC) recently formalized a crucial…

Business

February 15, 2026

David Dearsley: Maritime Relations Pioneer Remembered | Mariner News

The maritime world mourns the passing of David Dearsley, a true titan whose influence on…

Containers

February 15, 2026

HMM Forecasts Vessel Oversupply to Hit Shipping Market | Mariner News

Korea’s flagship container line, HMM, is sounding the alarm over an anticipated vessel oversupply that…

Containers

February 15, 2026

Synergy Marine to Operate Yang Ming Newbuilds | Mariner News

Synergy Marine Group, a leading global ship manager, has secured a significant agreement to operate…

Bulkers

February 15, 2026

2020 Bulkers Sells Vessels, Seeks New Growth | Mariner News

2020 Bulkers, a prominent player in the dry bulk shipping sector, has announced a significant…

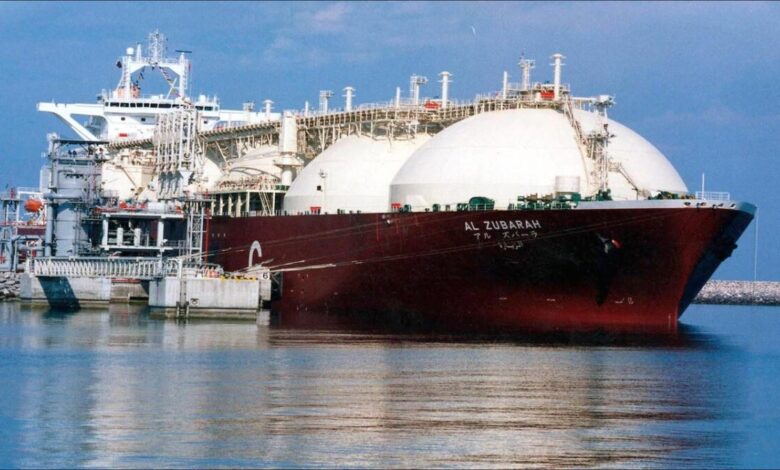

Tankers

February 14, 2026

Odfjell Adds 10 New Chemical Tankers to Fleet by 2026 | Mariner News

Odfjell, a leading player in the maritime industry, is set to significantly enhance its operational…

Tankers

February 14, 2026

Odfjell Adds 10 New Chemical Tankers to Fleet by 2026 | Mariner News

Odfjell, a leading player in the maritime industry, is set to significantly enhance its operational…